4 reasons why 2024 is a turning point for Merger Arbitrage strategies

2024: A rebound in M&A activity after a 3-year down cycle!

Since the end of 2023, headwinds to corporate confidence are reversing and all the drivers of the recovery are already in place for 2024:

Monetary easing on the horizon should enable financial buyers to return to the market.

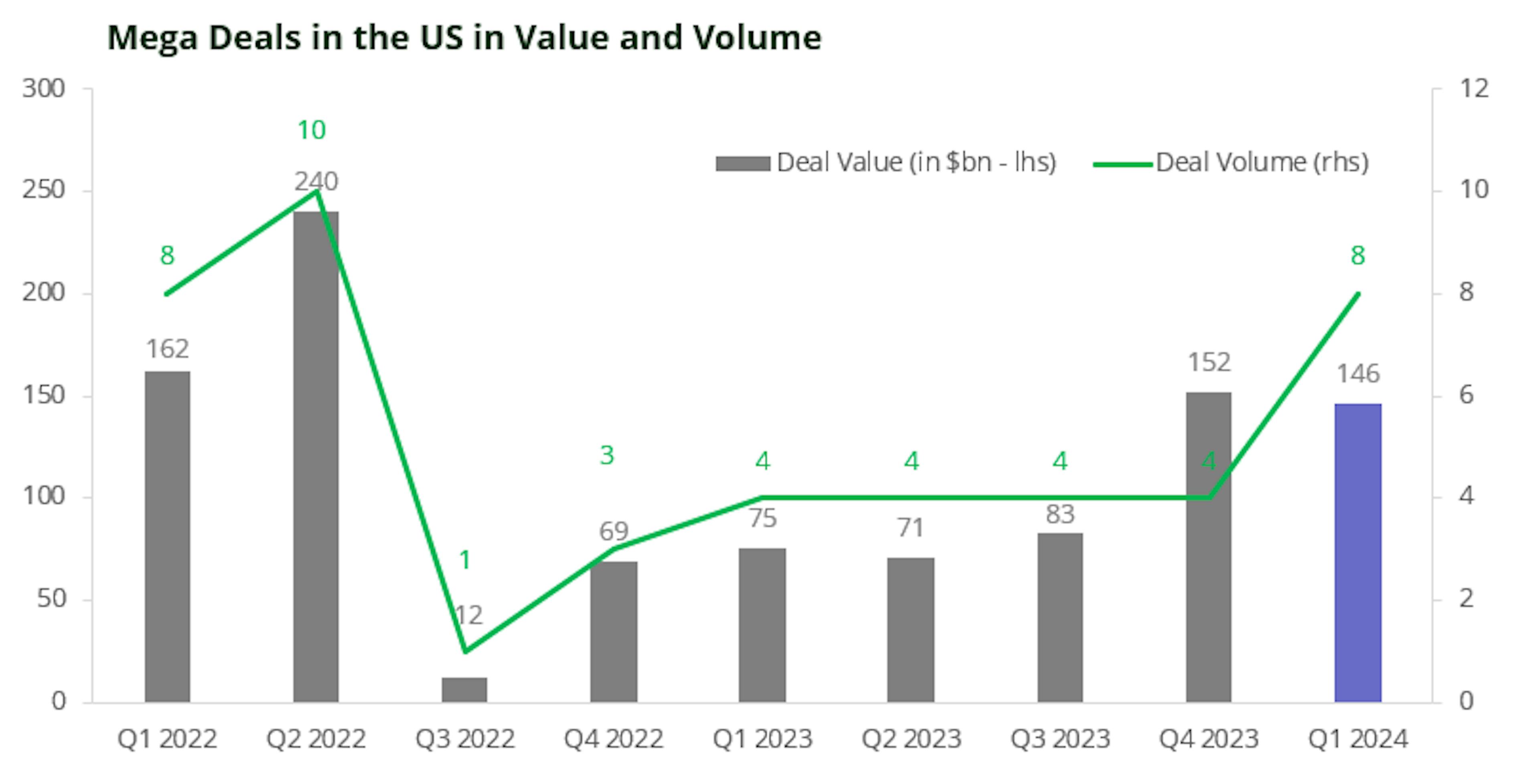

The slowdown in growth and the gradual return of inflation to the 2% target, so eagerly awaited by the Federal Reserve (Fed), should enable the Fed to lower its key rates from June onwards. Even if rates remain elevated, the recent clarity on Fed cuts is expected to boost M&A activity. This is because it will make it easier and cheaper for companies to secure financing for their deals.Return to mega-deals, 8 deals worth over $10 billion were announced in the 1st quarter of 2024, compared with just 4 in the last quarter of 2023, driven by large US deals in the Energy, Technology and Financial sectors. The number of global operations announced in the first three months of the year totaled 92, up 48% on the same period last year. The return of “mega deals” is a clear sign of confidence among corporate leaders.

Sectoral shift in M&A activity towards the "old economy" driven by the energy transition, both in Europe and the USA. Three years of weak M&A activity have helped to begin preliminary discussions in strategic sectors such as artificial intelligence, cloud capabilities, clean energy transitions and/or reshoring which should support this cycle too.

New Japanese takeover guidelines, announced in August 2023, should drive business recovery in Asia and thus provide access to a potentially large reservoir of performance.

A higher Merger Arbitrage remuneration…

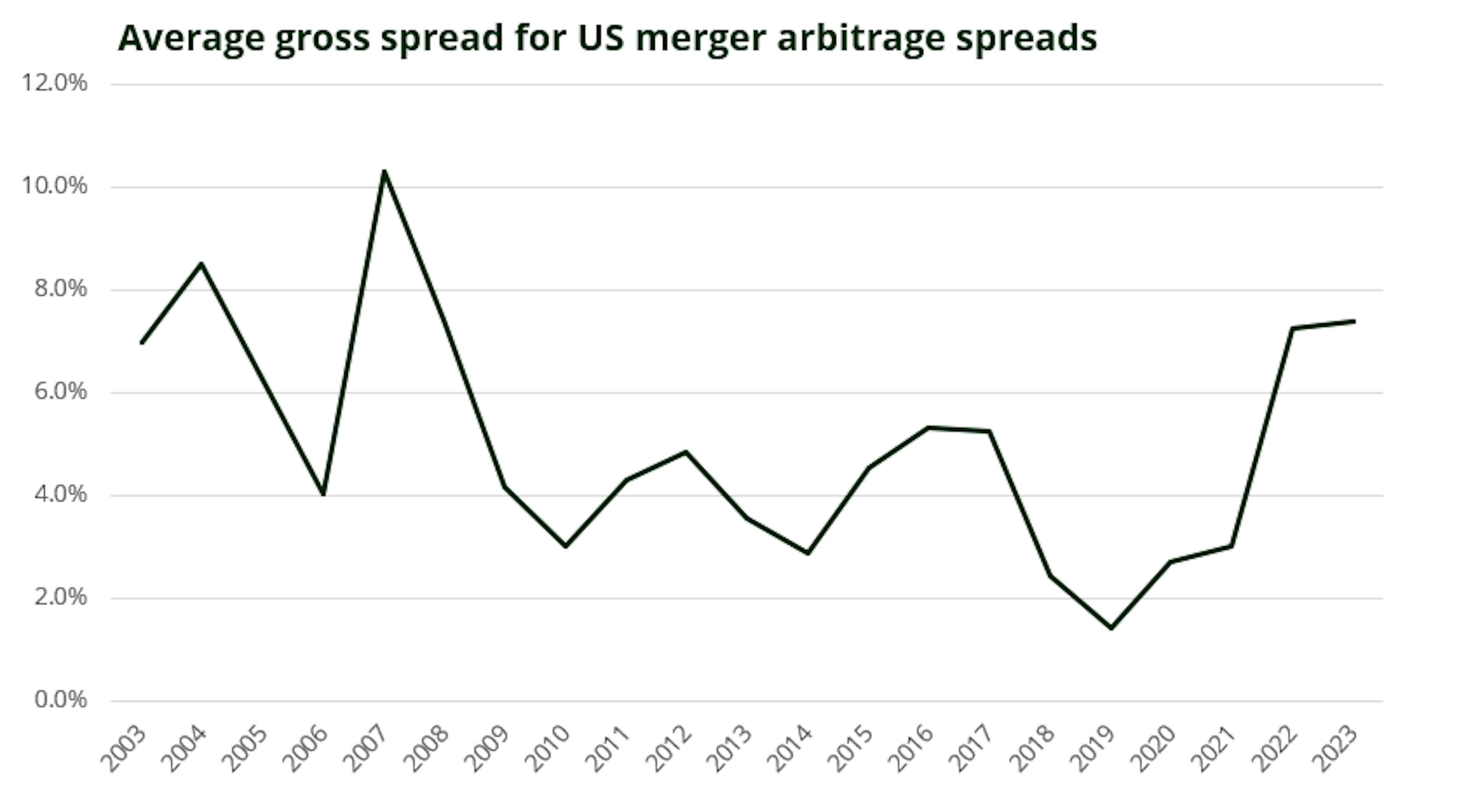

- We have now more attractive merger arbitrage spreads. Spreads have started to reflect rising rates and repricing of risk premium. The M&A risk premium is the risk that the deal is not completed but note that this risk is idiosyncratic as they are deal specific.

- The advantage of having higher risk-free rates and moving away from a zero/negative rate environment enables better remuneration for each operation.

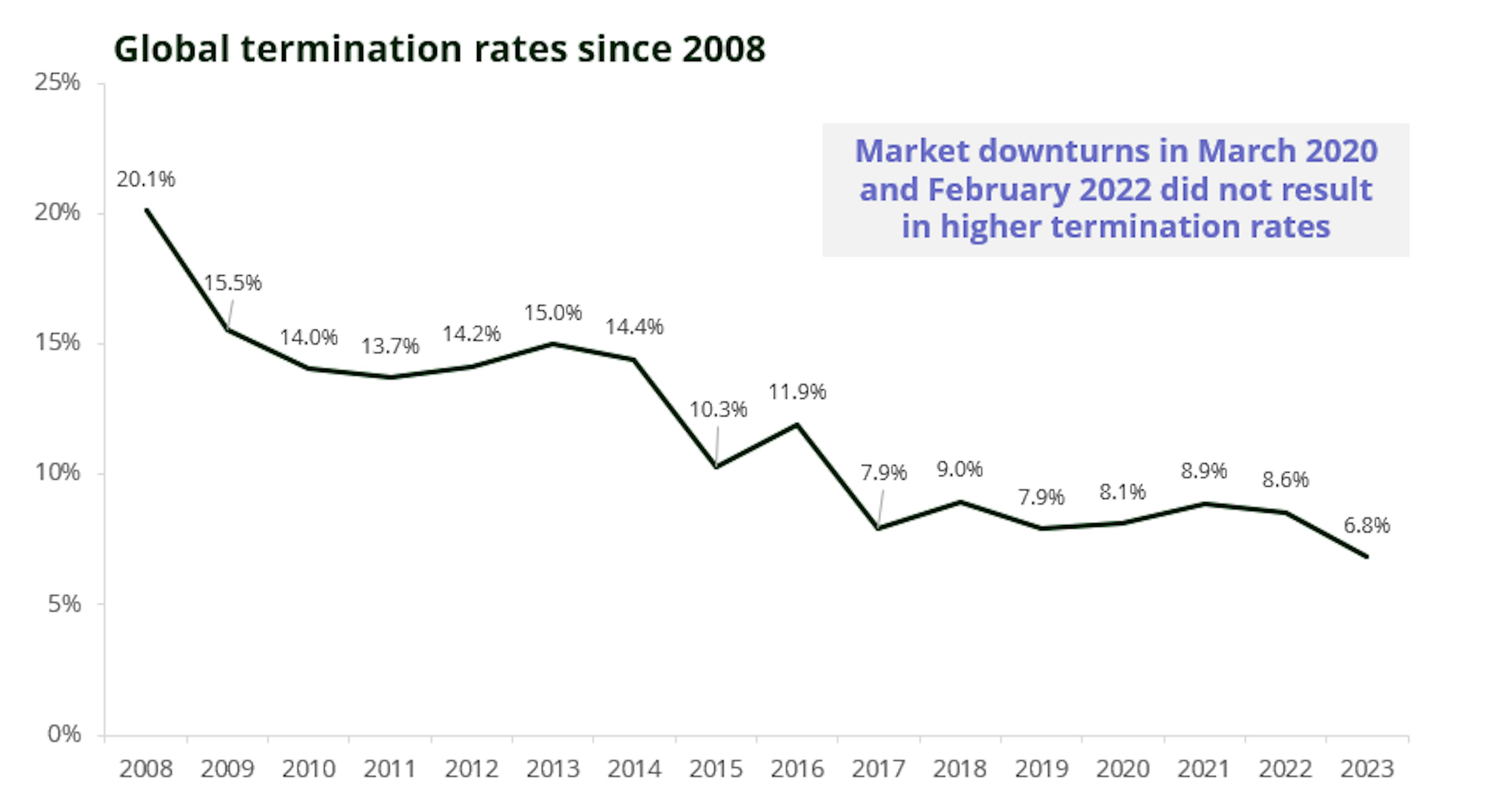

…along with lower termination rates

We are currently at termination rate levels close to historical lows. In other words, the risk of an M&A deal being abandoned is much lower than in previous years. Hence, this means that we are now better remunerated for less termination risk.

For example, the percentage of a deal failure has been reduced thanks to greater clarity on interpretation of antitrust laws. This greater visibility is crucial in M&A to determine what types of deal will be challenged in the future and the length of time/costs this may entail.

- Finally, now that fear of recession is no longer the central scenario, and we are operating in an environment of lower inflation and resilient growth, the return of investor confidence since the end of 2023 should continue to foster this buoyant environment and maintain low termination rates.

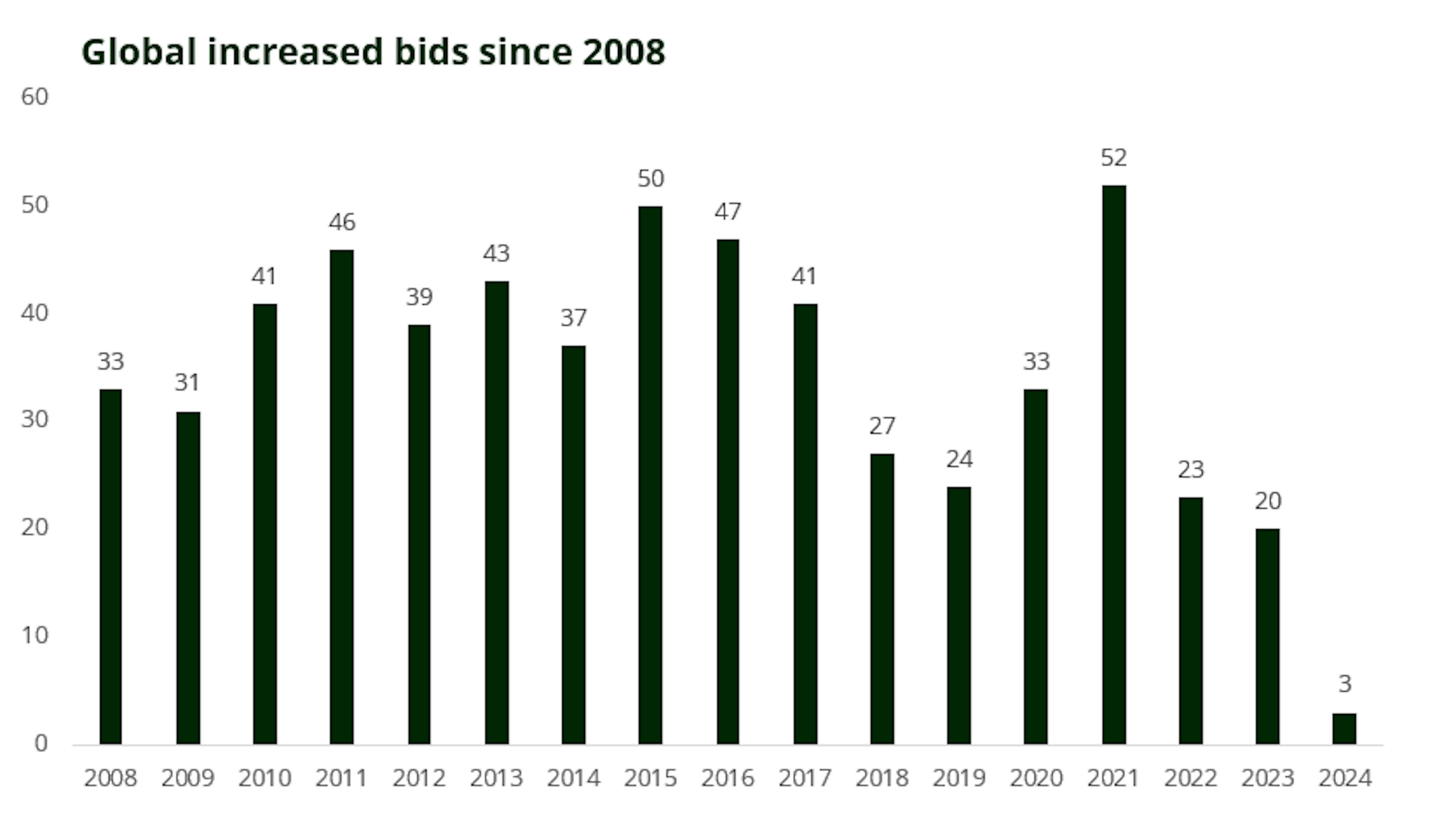

and lastly increased bids are back!

- The first three months of the year have already seen a number of outbids: as an example, in January, the Swedish IT services company Pagero Group was the subject of a battle between three players in the sector (Avalara, Thomson Reuters, Vertex), which resulted in the terms of the offer being improved by almost 39%.

In February, the shipping company CMA CGM saw its bid for the British logistics services company, Wincanton countered by a 37% higher offer from the American company, GXO Logistics.

Finally, still in the UK, equipment manufacturer, Spirent Communications is being coveted by two industry players, Keysight Technologies and Viavi Solutions. The target's shares climbed 12% over the terms of the first offer during March.

Carmignac Portfolio Merger Arbitrage Plus I EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 3/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- We do not charge an entry fee.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,11% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance if the performance is positive and the net asset value exceeds the high-water mark. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,84% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Carmignac Portfolio Merger Arbitrage I EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- We do not charge an entry fee.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 0,62% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,30% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Related articles

Carmignac Portfolio Human Xperience celebrates its three-year anniversary

Sustainable bonds: an investment opportunity?

2024: A game changer for Emerging Markets

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In France, Luxembourg, Sweden: The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital. The Funds’ prospectus, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.