Carmignac appoints top-performing equity Manager for Flagship Strategies

Carmignac has appointed Kristofer Barrett, a top-performing global equities manager to its London-based investment team. He will join the business on 8 April 2024.

Kristofer will take over management of the Carmignac Investissement strategy and the equity portfolio of the Carmignac Patrimoine strategy. Kristofer will also join the firm’s strategic investment committee.

This appointment coincides with the decision by David Older to retire. He will leave the business on 4 April 2024. Mark Denham, an accomplished equities investor who has managed European and global equity funds at Carmignac since 2016, will become head of equities.

On the Carmignac Patrimoine strategy, Kristofer will work alongside two expert duos, in line with the strategy’s team approach, consisting of three performance drivers (equity selection; fixed income and currency management; and macro-overlay, portfolio construction and risk management).

Kristofer is a US and Swedish national. He studied business and finance at Uppsala University and joins Carmignac from Swedbank Robur, where he worked since 2006 running several developed and emerging market equity funds. In April 2016, Kristofer took over management of a now Morningstar five-star rated €10 bn global equities strategy and in March 2020, he was appointed manager of a now Morningstar five-star rated €12.8 bn technology equity strategy1.

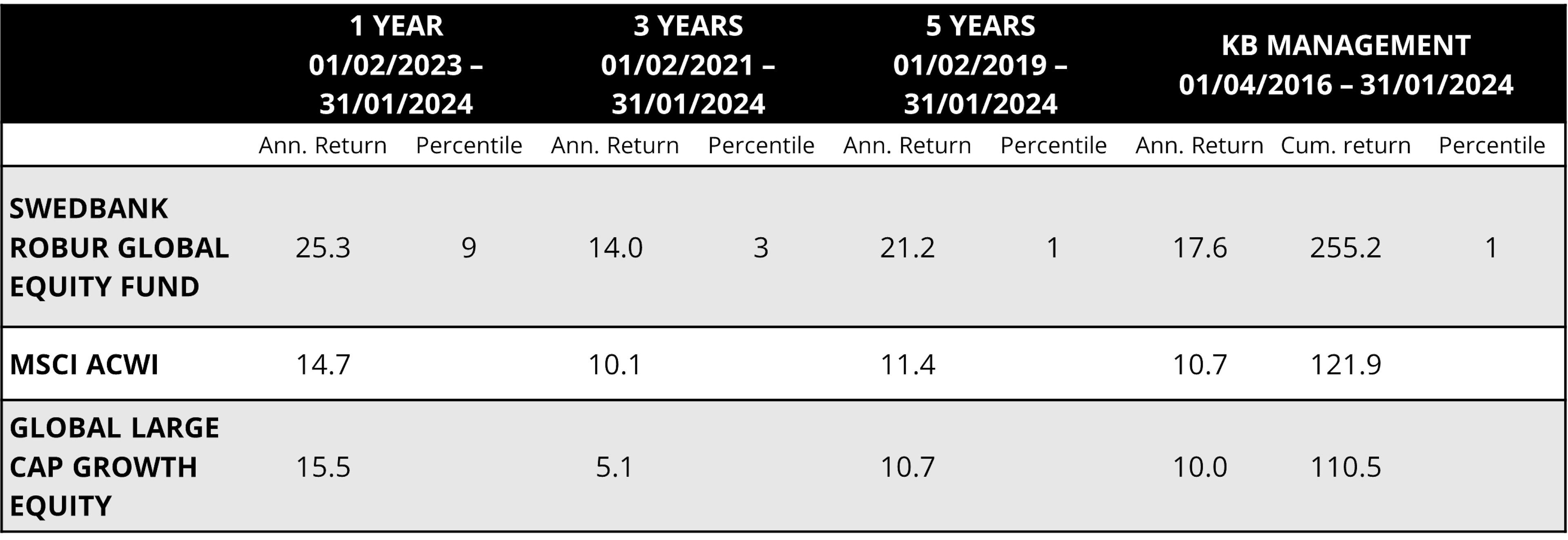

Kristofer is a seasoned, active stock picker. His proven approach of combining in-depth company research with pragmatic macro analysis has resulted in an outstanding long-term track record. During his tenure as manager of the global equity fund (starting April 2016) he delivered an outperformance of 133% and 145% versus the index and category average, and assets grew nearly five-fold2. Similarly, during his management of the technology equity fund (starting March 2020) the fund outperformed the index and category average by 105% and 89% and assets nearly tripled3.

Edouard Carmignac comments: “Kristofer’s appointment is a testament to Carmignac’s attractiveness to entrepreneurial-minded individuals, with a passion for active, conviction-driven investing. His track record is extremely impressive and I’m convinced his tried and tested process will prove to be highly beneficial for our clients over the long term.

I’d also like to thank David Older for his contribution to the business. He’s played an integral role in the development of Carmignac’s equity structure. I’d like to wish him the best for the future.”

Kristofer Barrett adds: “The coming years are set to be pivotal for equity markets. I am convinced that active management – and the ability to put conviction investing to work - is the key to success in this changing environment. Carmignac is renowned for its contrarian approach and I look forward to joining its accomplished fund management team.”

David Older concludes: “After nine fulfilling years at Carmignac, now is the right time for me to retire. I’m leaving the team, and funds, in safe hands and look forward to watching Carmignac’s continued success.”

Performance of Kristofer Barrett’s Swedbank Robur funds

Past performance is not a guide to future performance

201/04/2016 – 31/01/2024. Strategy = 255.2% Index (MSCI ACWI) = 121.9%, Category average (Global Large Cap Growth Equity) = 110.5%. Assets = €1.8 bn to €10 bn. Performance measured in Euro.

301/03/2020 – 31/01/2024 .Strategy= 140.6%, Index (MSCI World/IT Services) = 35.9%, Category average (Sector Equity Technology) = 51.9%. Assets = €4.6 bn to €12.8 bn. Performance measured in Euro.

Carmignac Patrimoine A EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 3/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,51% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,63% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Carmignac Investissement A EUR Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 4/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 1,09% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Related articles

Carmignac launches Tech Solutions Fund to seize next wave of tech innovation

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In France, Luxembourg, Sweden: The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital. The Funds’ prospectus, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.