Carmignac Merger Arbitrage: Q1 2024 - Letter from the Portfolio Managers

With the prospect of central banks cutting rates, equity markets continued their rally in the first quarter of 2024. The Eurostoxx and S&P 500 rose by 12.9% and 10.6% respectively. On the other hand, the start of the year was more mixed for bond markets, with the US High Yield segment (Iboxx Liquid HY) up 1.3% and the Investment Grade segment (Iboxx Liquid IG) down 0.7%. In terms of to the Merger Arbitrage strategy, our CMA/CMAP funds returned respectively +0.92% and +0.89% in Q1 2024, while the Credit Suisse Merger Arbitrage Liquid index fell by 0.5% over the same period.

Performance review

First of all, most of our quarterly performance was achieved in the last month. Indeed, while the first two months of the year showed no real trend for our strategy, March saw a good performance driver, with the finalization of a large number of transactions. Among the most important were Cisco's $28 billion takeover of Splunk, Bristol-Myers Squibb's $11 billion acquisition of Karuna Therapeutics, and Campbell Soup's $3 billion purchase of Sovos Brands. Overall, nearly 21 deals were finalized in March, compared with just 7 in February. Once these deals had been closed and paid for, the capital redeployed on other deals still in progress resulted in a tightening of certain discounts, such as those on the Pioneer Natural Resources, Hess and Cerevel Therapeutics transactions.

At the start of this year, antitrust risk was the main source of volatility in Merger Arbitrage spreads.

In January, the American courts decided to block JetBlue Airways' takeover of Spirit Airlines for $3.6 billion, leading to a 60% fall in the target's shares. In the same month, Amazon withdrew its bid for iRobot under pressure from antitrust authorities in Europe and the US, resulting in a 65% drop in the shares of the vacuum cleaner manufacturer. While we were not invested in the first transaction, given the high risk of capital loss, we did have a small exposure to the second, which, despite the risk of failure, offered a very attractive return.

The month of March, however, was more favorable for certain projects where antitrust risks were a concern. Brookfield AM finally obtained approval from the United Arab Emirates (UAE) for its acquisition of Network International. Thermo Fischer Scientific's takeover of Olink was approved by the Icelandic antitrust authority and the Swedish Ministry of Foreign Affairs. After many months of uncertainty, Japan Investment Corp was finally authorized to withdraw its application for approval from the Chinese antitrust agency, enabling it to officially launch its bid for JSR. This last operation was one of the main contributors to our quarterly performance.

There were several notable increased bids during the 1st quarter.

In January, the Swedish IT services company Pagero Group was the subject of a battle between three players in the sector (Avalara, Thomson Reuters, Vertex), which resulted in the terms of the offer being improved by almost 39%. In February, the shipping company CMA CGM saw its bid for the British logistics services company Wincanton countered by a 37% higher offer from the American GXO Logistics. Finally, still in the UK, equipment manufacturer Spirent Communications is being targeted by two industry players, Keysight Technologies and Viavi Solutions. The target's shares climbed 12% compared with the terms of the initial offer in March. Our investment process enabled us to identify Pagero Group and Spirent Communications as potential situations of increased bids. These two positions thus made a positive contribution to our funds' performance in Q1 2024.

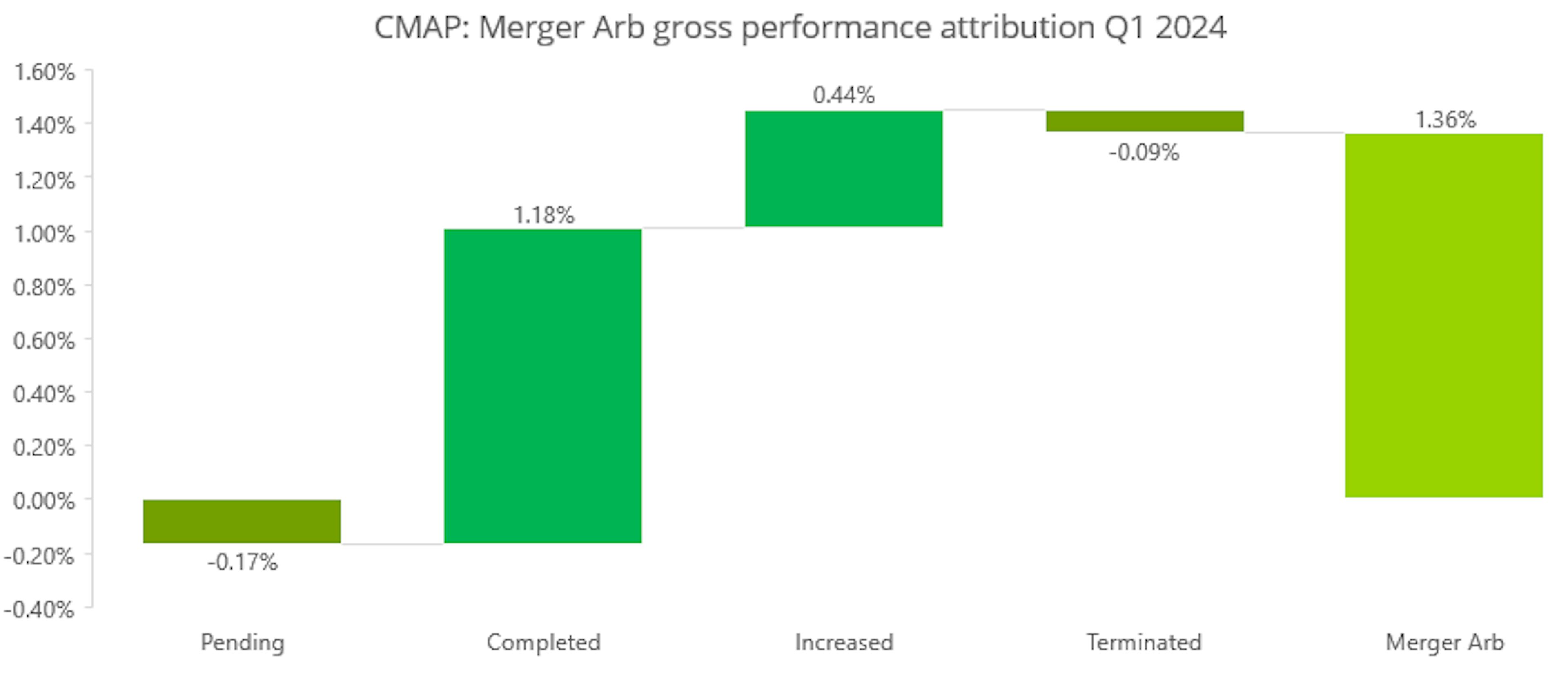

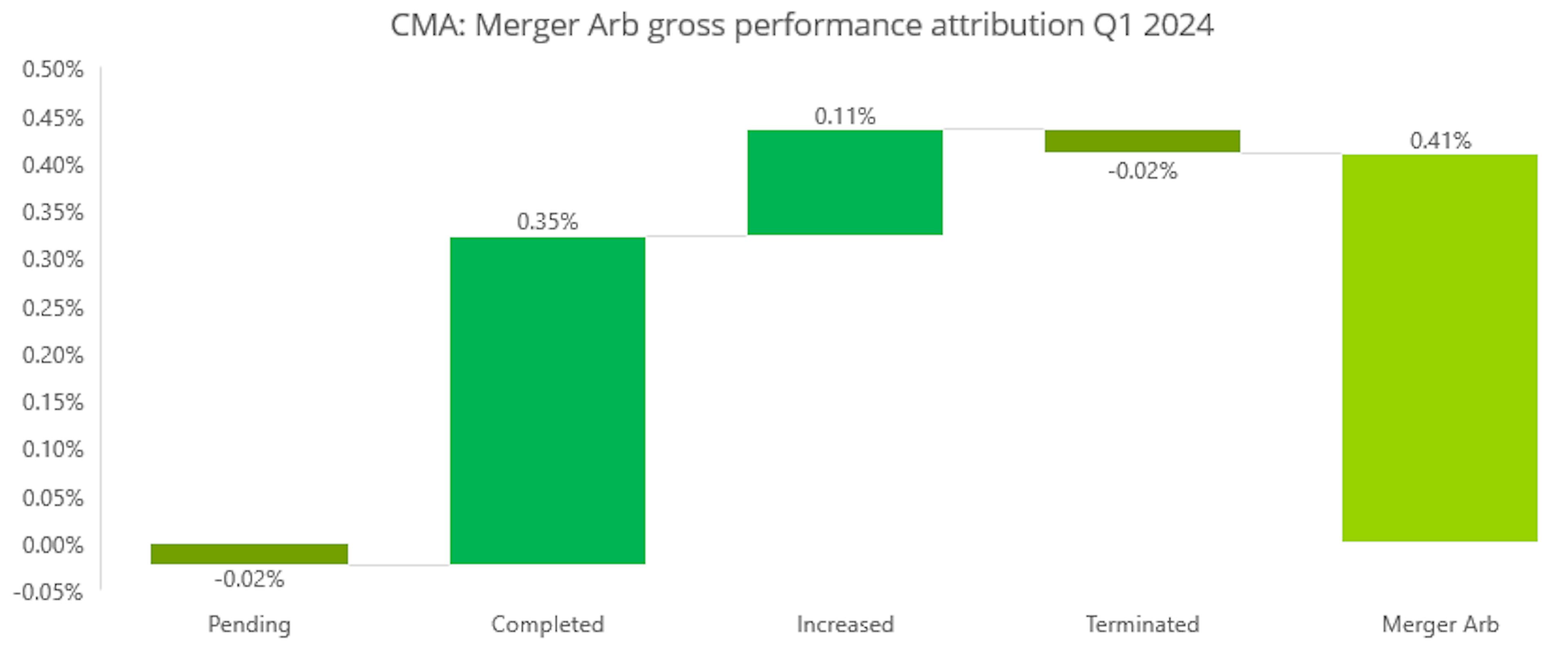

Another way of breaking down fund performance is to look at the status of the transaction at the end of the period. A takeover bid can be either:

- Pending: the operation has not yet been finalized, as all conditions precedent have not yet been lifted.

- Completed: the transaction has been finalized according to the initial terms.

- Increased: the buyer has increased its price or a third party has come in with a higher offer.

- Terminated: the operation has failed.

Using this methodology, we obtain the following table showing the local gross performance of the fund's Merger Arbitrage exposure (before management fees):

In this performance attribution, we note that the main driver of performance was the finalization of a large number of portfolio transactions during March. Given the high volatility of certain antitrust-risk spreads such as Capri and Olink, the "Pending" category made a negative contribution to performance over the quarter. We also noted a good contribution from the increased bids situations (Pagero Group and Spirent Communications), as well as a small impact from the iRobot failure.

M&A environment

The good news at the start of this year is the continuation of the good momentum in M&A activity observed since Q4 2023.

In fact, 92 new operations eligible for our portfolio were announced during Q1 2024, representing a 10% increase on the previous quarter and a 48% increase over the same period last year.

Two important facts stand out:

Firstly, and rather unexpectedly, Europe is the main driver of this growth: 29 deals were announced in Europe, up 93% on the same period last year. The UK alone accounted for more than half of the deals announced in Europe in Q1 2024. The weakness of the local currency combined with the attractive valuation of the equity market make the UK particularly attractive to foreign investors.

Secondly, the return of mega-deals is confirmed, with 8 new deals worth over $10 billion announced during the quarter, up 33% on the previous quarter and the same period last year. This recovery concerns all sectors of the economy, from technology to financial services, healthcare, consumer goods and energy. For both the target and the acquirer, mega-deals always represent a major strategic and financial risk, due to the difficulty of implementing them. That's why we believe that the return of this type of structuring deal is a real sign of renewed confidence on the part of business leaders, which should be one of the driving forces behind the recovery of the M&A business cycle in the medium term.

We believe that 2024 should be a good year for M&A activity. Indeed, a historical study of M&A activity shows that, while there is a certain cyclicality, downturns in activity tend to be short-lived on average and, for the current year, the engines of recovery are already in place:

- Approaching the end of the rate hike cycle, which should provide some visibility for business leaders.

- Return of mega-deals in most economic sectors.

- Sectoral shift in M&A activity towards the "old economy", driven in particular by the energy transition.

- New stock exchange regulations in Japan, aimed at opening up the market to M&A activity.

- A greater proportion of strategic players than financial players, who until now have been penalized by high interest rates.

- In certain sectors, such as Technology and Healthcare, external growth is structurally an integral part of development models.

Carmignac Portfolio Merger Arbitrage Plus I EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 3/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- We do not charge an entry fee.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,11% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance if the performance is positive and the net asset value exceeds the high-water mark. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,84% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Portfolio Merger Arbitrage Plus | 3.2 |

| Carmignac Portfolio Merger Arbitrage Plus | + 4.9 % | - | + 3.6 % |

Source: Carmignac at 28 Jun 2024.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Carmignac Portfolio Merger Arbitrage I EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- We do not charge an entry fee.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 0,62% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,30% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Portfolio Merger Arbitrage | 2.7 |

| Carmignac Portfolio Merger Arbitrage | + 4.2 % | - | + 3.6 % |

Source: Carmignac at 28 Jun 2024.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Related articles

Our Merger Arbitrage strategies win ‘Best new launch’ award

Best ESG Alternative Fund award goes to Carmignac

M&A Arbitrage: A key strategy in a high interest rate environment

Speakers : Fabienne Cretin-FumeronMarketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In France, Luxembourg, Sweden: The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital. The Funds’ prospectus, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.