Quarterly Report

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement : Letter from the Fund Manager

Quarterly performance review

Markets pursued their upward move boosted by the reopening of economies, ongoing highly accommodative Central bank policies and massive government fiscal support. However, after several months of outperformance of cyclical/value stocks, we saw a change in market leadership in the second half of the quarter with growth stocks outperforming. This move has been accelerated by a change in the Federal Reserve’s tone in June as inflation fears were rising.

Overall, the outlook remains constructive for equity markets, with the “runaway” inflation scenario receding thanks to a more vigilant Fed. Secular growth stocks should benefit from this environment especially at a time when overall corporate earnings growth will decelerate, making their steady growth relatively more attractive. In addition, the probability of sharp US tax increases is decreasing as fiscal spending seems to be curtailed somewhat by a divided US Congress.

In this context, Carmignac Investissement benefited from its balanced positioning with a performance coming from both secular growth stocks and reopening trades. Among our top contributors of the quarter, we note Hermès, that is supported by strong demand in China as well as e-commerce rollouts to more countries. Alphabet and Facebook also recorded strong gains thanks to supportive trends in digital advertising. In healthcare, Chinese biologics technology platform Wuxi Biologics and Chinese vaccine company Chongqing Zhifei were strong performers.

On the other hand, outside of the Healthcare sector, Chinese exposure in the fund continued its 2021 underperformance hurt mainly by regulatory attacks on Internet companies and their technology partners. Longstanding positions like JD.com and Kingsoft Cloud have penalized the performance of the Fund this year but we remain convinced as to their potential value creation over time under new regulatory frameworks.

How is the fund positioned?

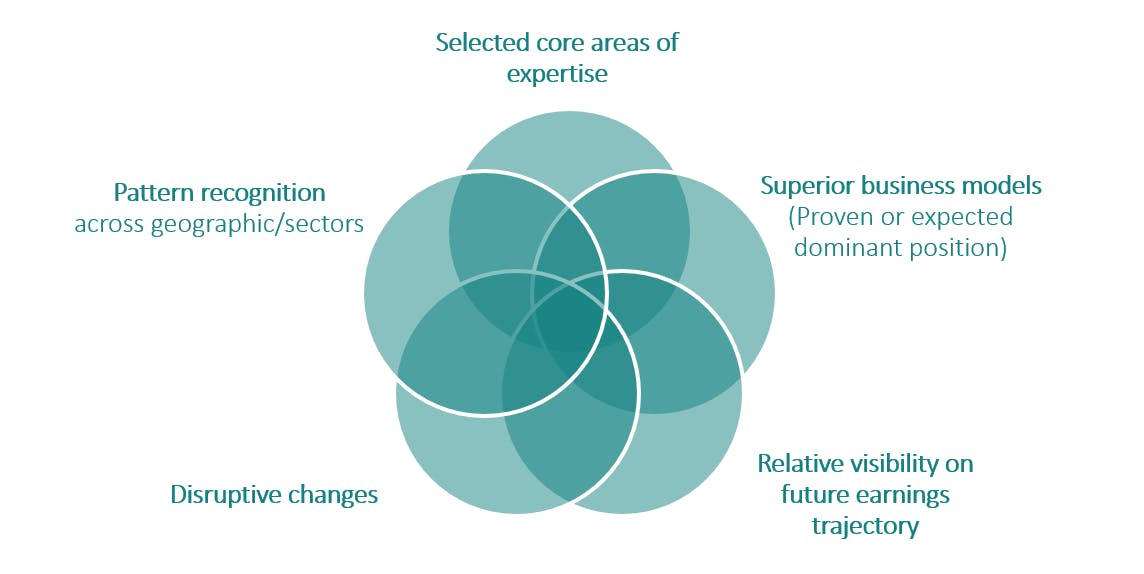

Our investment process revolves around identifying the most promising secular trends in order to invest in companies that show strong growth regardless of economic conditions. Social Responsible Investment (SRI) is a core part of our philosophy and is fully integrated in this process. This allows us to build strong convictions that can outperform over the long term, and to avoid secularly challenged businesses that fail to offer long term attractive and visible growth. This approach, however, did not prevent us from adding some cyclicality to the portfolio this year such as a basket of high-quality US Industrials, and travel names levered to tourism such as Ryanair which supported performance.

As we ended the second quarter, the most cyclical part of the market, especially in the United States, has reflected the growth recovery leading us to exit the Industrial basket and reduce/exit several positions geared to capitalize on the reopening of economies, such as Booking.com (online travel), and Carnival (cruise lines).

What is our outlook for the coming months?

As we enter the second half of 2021, we continue to pay particular attention to stocks with high valuation multiples in an environment of potential rate hikes. We have therefore weighted the portfolio towards growth stocks offering valuations that we judge reasonable, and which can be found among certain mega-caps such as Facebook and Google. Facebook has an estimated price-earnings (P/E) for 2021 in line with the S&P 500 with vastly superior growth. Sector rotation and regulatory uncertainties have penalized the share price but do not take into account the outlook for its unmonetized initiatives like in-app “social” commerce and virtual reality, which has been a focus of multi-billion-dollar investment in recent years and which we believe will be the next interactive social platform. In addition, the regulatory environment around Facebook improved at quarter end as the company won a court ruling dismissing two monopoly lawsuits filed by the U.S. government and a coalition of states that sought to break up the company. This risk was identified as an environment, social and corporate governance (ESG) risk for the company leading us to monitor it very closely alongside all subjects linked to consumer data privacy practices.

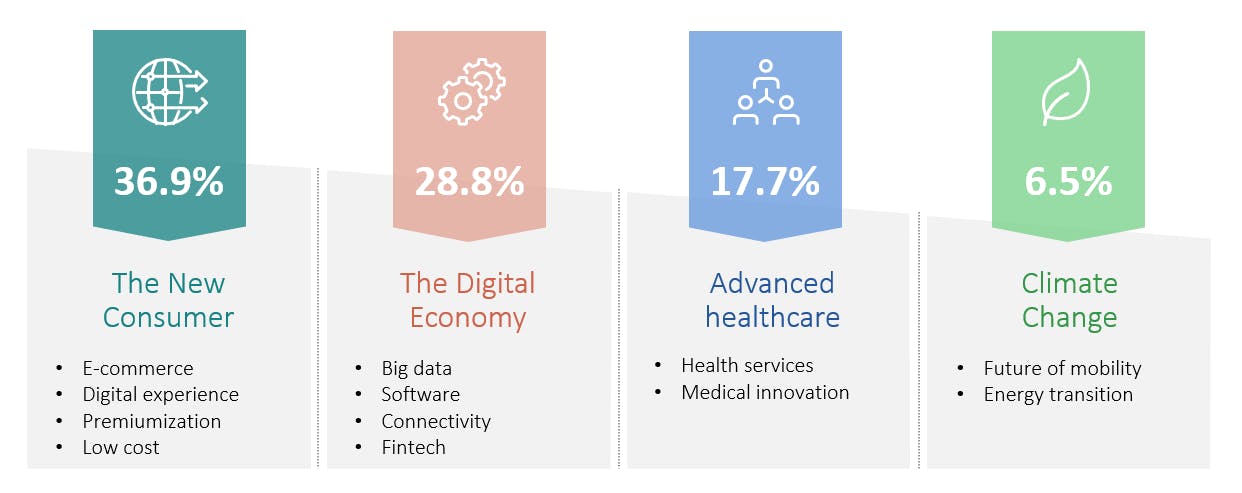

Overall, we maintain a liquid and solid portfolio of strong conviction investments, diversified in terms of geography, sectors and themes. Our core thematics revolve around :

These disruptive themes have proven to be particularly resistant to the global economic downturn brought on by COVID. Many of their adoption curves have sharply accelerated, driving up penetration rates and sustainable profits. As global economies reopen it is our strong belief that these penetration gains will be maintained: consumers and businesses will continue to embrace the powerful trends of e-commerce, digital payments, cloud infrastructure, online advertising, and medical advancement.

Carmignac Investissement A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Investissement A EUR Acc | +10.39 % | +1.29 % | +2.13 % | +4.76 % | -14.17 % | +24.75 % | +33.65 % | +3.97 % | -18.33 % | +18.92 % | +21.41 % |

| Reference Indicator | +18.61 % | +8.76 % | +11.09 % | +8.89 % | -4.85 % | +28.93 % | +6.65 % | +27.54 % | -13.01 % | +18.06 % | +14.72 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Investissement A EUR Acc | +3.46 % | +11.61 % | +7.69 % |

| Reference Indicator | +9.06 % | +12.09 % | +11.12 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 1,09% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Carmignac Investissement A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

1Peer group: Global Large-Cap Equity

2Reference indicator: MSCI ACWI (USD) (Reinvested net dividends).

3Takeover on January 1st, 2019. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor).