Back to school 2023 - Carmignac P. Emergents

-

+6.2%2023 YTD performance of Carmignac P. Emergents

versus +2.8% for its ref. indicator.

-

+27.3%Relative performance of the Carmignac P. Emergents F EUR Acc over 5 years

vs its reference indicator MSCI Emerging Markets NR Index.

-

1stQuartile ranking for Carmignac P. Emergents for its YTD, 1Y, 3Y and 5Y returns

vs its Morningstar category peers (Global Emerging Market Equity) as of 31/08/2023.

YTD market & fund overview

In 2023, EM Equities were slightly up but they underperformed global equities, being dragged down by high interest rates and the selloff of Chinese markets amid US-China tensions & slower than expected recovery.

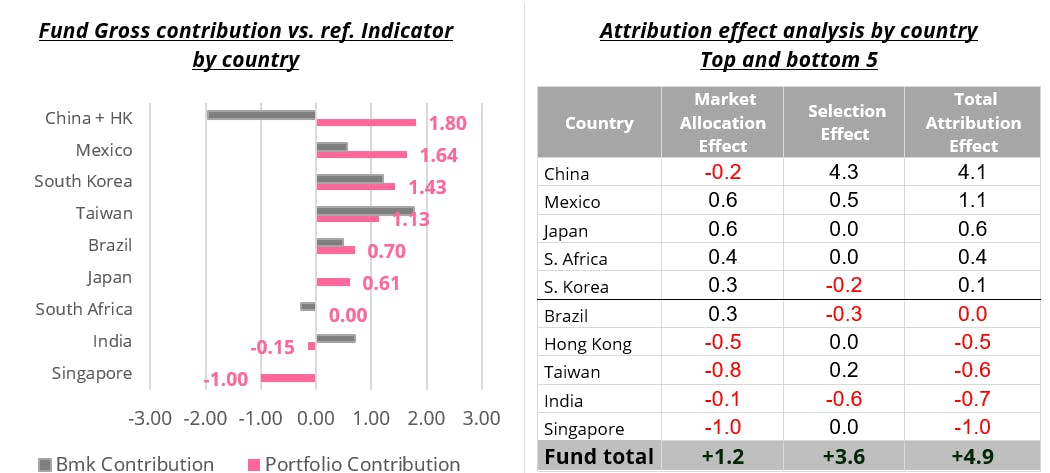

Against this backdrop, Carmignac P. Emergents managed to outperform its ref. indicator, benefiting from:

The solid rebound in our Asian tech stocks, amid growing interest for semiconductors and AI. Positive contributions from world’s leading chip maker Taiwan Semiconductor, South Korea’s Samsung Electronics and Japanese semiconductor equipment specialist Tokyo Electron.

Its increased exposure to Latin American countries. Mexico (9.2% of the Fund’s assets) was the best-performing large EM in 2023, thanks primarily to Nearshoring, benefitting to our Mexican and pan LatAm holdings (Grupo Banorte, MercadoLibre). Our Brazilian names also posted a positive contribution, thanks to the rebound of our infrastructure/ utilities company Equatorial Energia.

However, against a difficult period for Chinese markets, we suffered from the weakness of some of our Chinese consumer (JD.com, Anta Sports) and healthcare holdings (Wuxi Biologics).

-

TOP 5 YTD CONTRIBUTORS

- MINISO Cons. Disc. China

- NEW ORIENTAL Cons. Disc. China

- TAIWAN SEMICONDUCTOR Tech Taiwan

- GRUPO BANORTE Finance Mexico

- MERCADOLIBRE eCommerce Brazil

- MINISO Cons. Disc. China

-

TOP 5 YTD DETRACTORS

- JD.COM Cons. Disc. China

- SEA LTD eCommerce Singapore

- ANTA SPORTS Cons. Disc. China

- WUXI BIOLOGICS Healthcare China

- ELETROBRAS Utilities Brazil

- JD.COM Cons. Disc. China

Throughout the year, we decided to maintain an overweight position in China as we believe the valuations of the quality companies that we have on the portfolio had become too extreme and disconnected from their good fundamentals.

This proved to be the right strategy as our top Chinese convictions posted solid returns YTD, ahead of consensus estimates (New Oriental, Beike, Miniso, JD), with Miniso and New Oriental enrolling among our best contributors YTD (see above).

We also benefited from our hedging strategy on the Chinese Yuan, implemented at the beginning of the year to protect our Chinese portfolio in a context of weakening RMB.

Notable portfolio moves

Outlook and positioning

For the remainder of the year, we maintain a constructive view on emerging markets, against backdrop of attractive valuations and the secular growth trends we see across EM (AI revolution, Nearshoring).

Concentrated portfolio: We have a concentrated portfolio with 35 holdings, and the ten biggest holdings make up 51% of the Fund’s assets, with particular attention paid to valuations. This high concentration reflects our desire to focus on those companies with our strongest conviction level and strongest fundamentals in this extremely uncertain market climate.

Increased focus on bottom-up fundamentals & valuations: In a rising rate environment, financial health and valuation continue to be primary considerations for us, as evidenced by our top 10 positions, which are made up of stocks for which we have a lot of confidence on valuation. We are convinced that our highly selective approach, coupled with the strength of our portfolio companies’ balance sheets, should enable us to outperform at a time when interest rate hikes by the main central banks are making things difficult for investors.

A strong focus on sustainability in line with our Article 9 mandate: our sustainability guidelines and objectives remain a primary focus for the Fund. Through each investment, we aim to contribute to UN Sustainable Development Goals (SDGs), while also achieving carbon emissions 50% below our reference indicator.

Performance drivers for months to come

Strong conviction in Asian Tech names: we continue to see a lot of value on the Asian tech and semiconductor names that are one of the main beneficiaries of the AI revolution that drove up the stock prices of US companies like Nvidia and Microsoft but isn’t yet reflected in Asian companies’ prices such as TSMC or Samsung Electronics despite their unique expertise & dominant market shares in their respective markets.

Increased allocation to Latin America: In order to take advantage of the Nearshoring trend in Mexico and the improving fundamentals in Brazil, we have stepped up our exposure to Latin America (19% of Funds net assets versus 10% for the ref. indicator). We are positioned on the industrial real estate sector in Mexico (Vesta) and key infrastructure and utilities companies in Brazil (Equatorial).

Selective opportunities in China: maintaining our decent allocation to the Chinese markets (37% of net assets), to take advantage of the growth potential of solid balance sheet consumer companies that are trading at prices that don’t fully reflect their underlying fundamentals and growth prospects.

In China, our approach is centered on bottom-up stock selection, focusing on company fundamentals and valuations.

Almost all the Chinese companies in our EM portfolios are leaders in their sector, with strong cash flow profile and solid balance sheet, benefiting from the large amount of cash they are able to deploy to boost their market share and solidify their market-leading position following the gradual normalization of the economy post-reopening, while their weaker competitors have exited the market or are struggling.

On the contrary, we try to avoid cyclical companies (banks, property developers, materials and energy companies) that seem vulnerable in the current environment.

Carmignac Portfolio Emergents F EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Carmignac Portfolio Emergents F EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Emergents F EUR Acc | +6.45 % | +3.92 % | +1.73 % | +19.76 % | -18.22 % | +25.53 % | +44.91 % | -10.29 % | -14.35 % | +9.79 % | +5.61 % |

| Reference Indicator | +11.38 % | -5.23 % | +14.51 % | +20.59 % | -10.27 % | +20.61 % | +8.54 % | +4.86 % | -14.85 % | +6.11 % | +10.79 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio Emergents F EUR Acc | -5.58 % | +7.58 % | +5.49 % |

| Reference Indicator | -1.81 % | +4.35 % | +5.34 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | We do not charge an entry fee. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,32% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,37% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |