Carmignac P. Emergents: October 2022 Update

Portfolio News

Performance - F EUR ACC shareclass - Cumulative returns (%)

| Oct 2022 | YTD | 1 year | 3 year | |

|---|---|---|---|---|

| Carmignac P. Emergents | -2,2% | -17,9% | -22,7% | +14,8% |

| Reference Indicator | -4,0% | -18,8% | -19,9% | -1,4% |

Reference indicator: MSCI EM (Reinvested net dividends)

As of 31/10/2022. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations. The fund presents a risk of capital loss.

Market Review

Emerging markets were down in October, underperforming developed markets, due to the fall of Asian markets and more specifically Chinese markets.

Chinese equities went down following the CCP Congress where Xi Jinping reinforced its grip on the party leadership, with the nomination of 4 new members to the Standing Committee, all with close ties to Xi. Markets reacted negatively to the fact that there was no change in zero-Covid policy or an appeasement on Taiwan.

China also suffered from increased geopolitical tensions, with a new round of sanctions from the Biden administration on semiconductor companies.

Asian Equities were also weak amid higher US rates. On the contrary, Latin America and EMEA (commodity exporters) performed much better supported by OPEC+ announcement of a 2 million barrel/day cut.

Another key highlight of the month was Brazil’s strength after the results of the Presidential elections, with the victory of the leftist Lula and the regional elections, with center and right-wing majority in the Congress. The result was seen as market friendly, as it leads lower the political risk premium on deeply undervalued Brazilian assets.

Performance Review

-

TOP 3 CONTRIBUTORS

BANORTE (Finance) - Mexico

SAMSUNG ELECTRONICS (Tech) - S. Korea

B3 BOLSA (Finance) - Brazil

-

TOP 3 DETRACTORS

JD.COM (Cons. Disc.) - China

HK EXCHANGES & CLEARING (Tech.) - Hong Kong

ENN ENERGY (New Energy) - China

Notable portfolio moves

New positions:

Reinforcements: Eletrobras (Brazil), B3 Bolsa (Brazil), Mercadolibre (Brazil), Banorte (Mexico), BEIKE (China), Lenovo (China)

Reductions: JD.com (China)

Positions sold: VIPSHOP (China), Wuxi Biologics (China), Full Truck Alliance (China)

Number of holdings: 35 (target range 35/55)

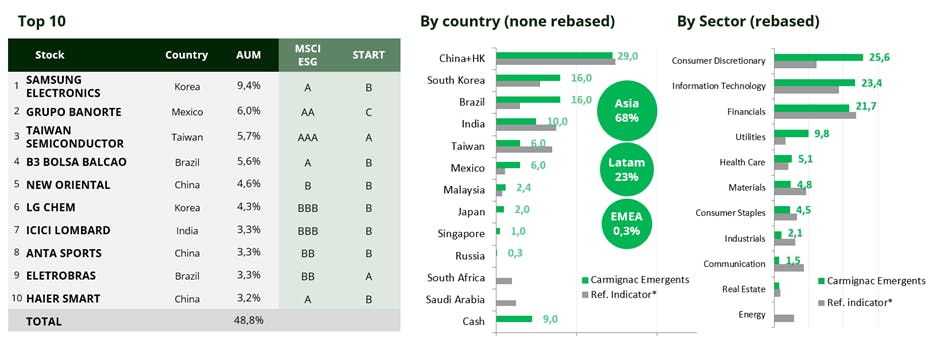

Positioning

Positioning as of 30/09/2022

Our portfolio is currently structured around 4 major socially responsible investment (SRI) themes that are central to our process:

Breakdown of the fund by SDG alignment

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. Data as of 31/10/2022. Source: Carmignac, 31/10/2022

Strategy reminder

Carmignac Portfolio Emergents F EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Emergents F EUR Acc | +6.45 % | +3.92 % | +1.73 % | +19.76 % | -18.22 % | +25.53 % | +44.91 % | -10.29 % | -14.35 % | +9.79 % | +5.61 % |

| Reference Indicator | +11.38 % | -5.23 % | +14.51 % | +20.59 % | -10.27 % | +20.61 % | +8.54 % | +4.86 % | -14.85 % | +6.11 % | +10.79 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio Emergents F EUR Acc | -5.58 % | +7.58 % | +5.49 % |

| Reference Indicator | -1.81 % | +4.35 % | +5.34 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | We do not charge an entry fee. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,32% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,37% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Carmignac Portfolio Emergents F EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.