Carmignac's Note

![[Main Media] [Carmignac Note] [Main Media] [Carmignac Note]](https://carmignac.imgix.net/uploads/article/0001/03/%5BMain-Media%5D-Carmignac%27s-Note_Market_Analysis.jpg?auto=format%2Ccompress)

Does Putin’s invasion of Ukraine mark the dawn of a new economic order?

Putin’s invasion of Ukraine is a decisive event with major implications, initially humanitarian and subsequently economic. It caught the vast majority of western observers off guard – including asset managers like us.

Our bond funds held Russian debt in their portfolios at the time of the invasion, at a weighting that was reduced yet detrimental. Reduced, in light of the healthy fundamentals of Russian debt before the war broke out unexpectedly, and detrimental because of the sanctions that western countries have introduced against Russia. These holdings have already impacted the net asset values of some of our funds.

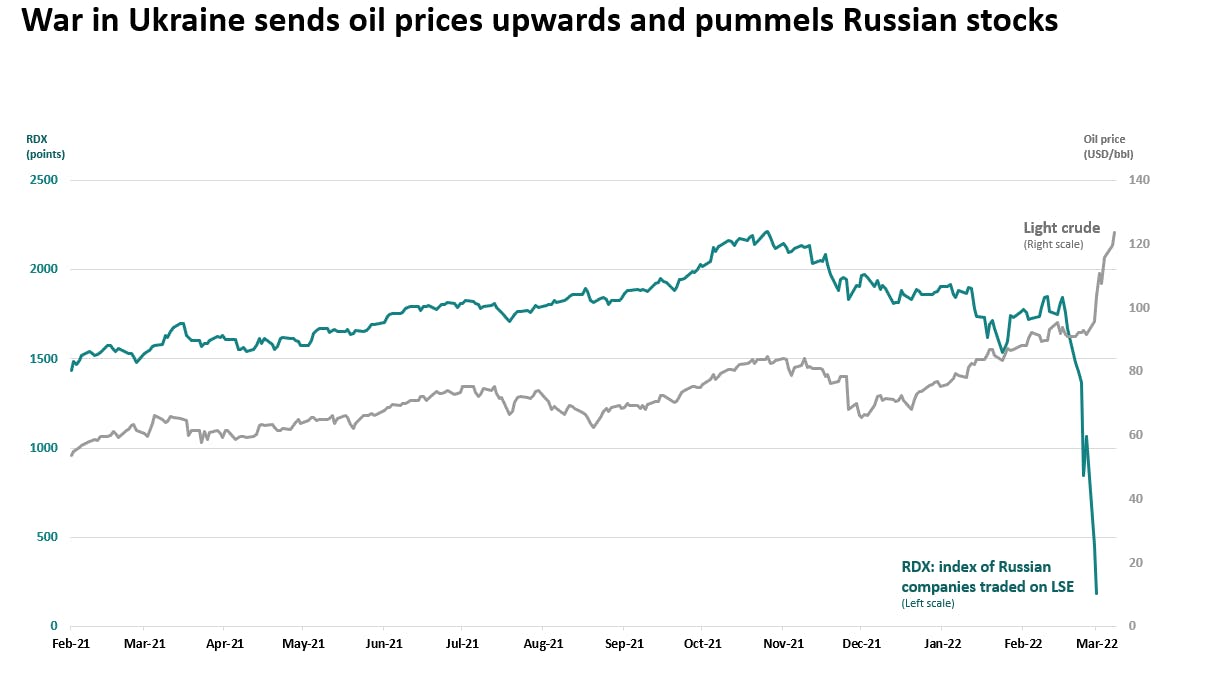

Both public and private Russian-debt instruments lost between 60% and 80% of their value almost immediately after the invasion. Russian companies listed in the UK – mainly banks and producers of oil and other industrial commodities – saw their stock prices fall 92%–99% between 16 February and 1 March, the last business day before trading was suspended. At the same time, natural gas prices in Europe temporarily shot up by a factor of 2.5 and oil prices jumped by 55%.

Source: Bloomberg

This large, nearly instantaneous adjustment in the prices of Russian assets and fossil fuels can be explained by two distinct factors.

The first is the economic sanctions, which a French minister boldly described as “an all-out economic and financial war on Russia”, adding that “we will provoke Russia’s collapse”. So far, the most severe sanctions have entailed expelling certain Russian banks from the SWIFT international payments system (meaning account holders can’t receive payment for their sales), freezing the assets that Russia’s central bank holds abroad (meaning it can’t prop up the rouble or service foreign-currency Russian debt), forbidding western countries from selling technology goods and services to Russia (causing many of its domestic industries to grind to a halt), freezing the foreign assets of key Russian business leaders and oligarchs (eroding their support for Putin), and introducing a US and UK embargo on the purchase of Russian oil and gas.

Moscow has taken a series of retaliatory measures in response. For instance, it has forbidden Russian companies from making debt payments in any currency other than the rouble and banned the export of some commodities, which could engender more bottlenecks in global supply chains. The sanctions will weigh heavily on Russia’s economy and could rapidly bring it to a standstill, but the retaliatory measures will similarly affect the rest of the world and accentuate two trends which had started before the conflict: rising inflation and slowing economic growth.

The second factor is the growing movement by investors around the world to incorporate environmental, social, and governance (ESG) criteria into their investment decisions, as part of efforts to promote sustainable finance. Asset managers who have committed to socially responsible investing, to align with the expectations of their clients and the financial advisors and fund selectors they work with, cannot keep investing in Russia as if nothing has happened. The most reasonable and legitimate response to be taken by such asset managers, a category which includes us at Carmignac, is to refrain from purchasing any Russian assets until further notice. Due to the sheer number of asset managers in this situation, it is creating huge downwards pressure on the prices of Russian securities, causing them to depreciate much further than would be warranted by the sanctions alone.

A considerable economic cost

Asset managers’ ESG commitments are also pushing up energy prices and speeding the transition to renewable energy. These commitments, coupled with the sanctions, retaliatory measures, and moves by western multinationals to pull out of Russia, are wreaking economic havoc. This could have the advantage of bringing about a negotiated resolution to the conflict more quickly, especially since signs are already appearing of the war’s potentially devastating consequences on the global economy.

Public opinion has largely backed governments’ response to Putin’s invasion. This response and the decisions taken by western investors and multinationals will come with a considerable economic cost. However, they also reflect society’s new aspiration to an economy that’s more ethical and puts less of a priority on the immediate financial gains which had driven so many economic decisions in the past decades.

The upshot of this new aspiration is it will make inflation a lasting part of our daily lives, beyond the price hikes related almost exclusively to the war in Ukraine. The tragic event is resulting in policies that will fuel inflation by expanding the range of different price drivers, such as a swifter transition to renewable energy, higher defence spending, new energy procurement routes, and the repatriation of production plants. These shifts will underpin higher prices for years to come before the benefits start to be seen in terms of economic efficiency.

Viewed from this perspective, the war in Ukraine marks the end of a four-decade-long trend of disinflation caused by ardent globalisation and favourable demographics, and is ushering in a new economic order. The new order will be one of deglobalisation, or the de-integration of global economies as countries erect barriers and prioritise energy and manufacturing independence – an issue which the pandemic and now the geopolitical tensions have propelled to the top of the agenda. This long-term trend reversal from disinflation to secular inflation will restore the appeal of long-forgotten sectors of the old economy, provided that the many constraints involved in bringing them back on domestic soil are rationally assessed. Many of today’s technological advancements should help restore these sectors and give them a formidable level of economic efficiency, at the end of the day. The world after COVID-19 and the invasion of Ukraine?

![[Divider] [Carmignac Note] Blue sky and building [Divider] [Carmignac Note] Blue sky and building](https://carmignac.imgix.net/uploads/article/0001/11/be5cc29afb5283f73a810bcb5b36e50673c56e99.png?auto=format%2Ccompress)

Investment Strategy

February was a month of heightened volatility in financial markets. Even before Russia invaded Ukraine, markets were already stressed by the prospect of monetary tightening as announced by major Western central banks. And recent developments have only underscored trends we had spotted previously – i.e., resilient inflation and a slowdown in economic growth – and which had already prompted us to begin reshuffling our portfolios. So far, Russian assets have experienced the most severe price correction, but we can expect to see widespread contagion to other asset classes – especially since the possibility of a recession can no longer be ruled out.

Our hedging strategies helped support the performance of our mixed funds during the market turbulence. The holdings of Russian sovereign and corporate debt in our Carmignac Patrimoine fund cost us, even though they accounted for under 5% of the portfolio. We made these investments nearly two years ago with a long-term perspective and after considering both financial and extra-financial criteria, as we always do. The conflict in Ukraine took investors and the international community by surprise. And given the current dislocation in Russian markets, we haven’t been able to liquidate all our holdings under conditions that would be in our clients’ best interests.

In February we further reduced risk levels in our portfolios, especially as geopolitical tensions escalated.

We are closely monitoring the effect the conflict could have on central banks’ plans to tighten monetary policy. It is unlikely to significantly alter the US Federal Reserve’s trajectory, but the story is different in the eurozone. Given that the currency bloc is located much closer to Ukraine and the impact on its economy will be greater, the European Central Bank (ECB) is more likely to adjust its policy stance – even though at its most recent meeting a week ago ECB President Lagarde said the bank still intends to follow the path outlined at its previous meeting in February. At that meeting, she announced the ECB would halt its asset purchases by the third quarter of 2022 at the latest. However, she was much more hesitant about giving a date for an upcoming rate hike, preferring instead to keep some flexibility.

In light of all of the above, we have decided to maintain a highly defensive positioning – at least until we start to see a resolution to the conflict, fiscal stimulus policies in Europe and China, or a broad market sell-off. We will keep a close eye on developments in Ukraine and the outlook for monetary tightening. When the time is right, we will increase our exposure by paring back our hedges. The current market volatility will give rise to a number of investment opportunities, which we fully intend to seize.

As we write this Note on 14 March, the equity allocation of our Patrimoine range of funds is under 5% and the modified duration of our bond portfolio is close to zero.

Sources : Carmignac, Bloomberg, 10/03/2022

Carmignac Patrimoine A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.