Flash Note

All Stars Aligned for Emerging Markets

As so-called ‘emerging’ countries managed to respond to the Covid-19 crisis more efficiently when compared to the rest of the world, it is likely that domestic companies will benefit from a more favourable economic environment.

“We are optimistic about emerging markets as there are both valuation and economic arguments in favour of those regions,” says Xavier Hovasse, Head of emerging equities at Carmignac.

Even though the pandemic began in Asia, the number of coronavirus cases per million people in the region, as well as in Latin America (except Brazil), has been much lower than in Europe or in the U.S. in 2020. The effective management of the health crisis has had a strong positive impact on emerging economies. Furthermore, in some countries, particularly in Asia, the estimated amount of money spent on supporting the economy in 2020 was far lower than in Europe and in the U.S. Less than 4% of GDP (Gross Domestic Product) in Asia was spent compared to more than 6% in Europe and over 8% in the U.S.

Therefore, emerging countries, especially China, showed signs of economic recovery much sooner than in so-called developed markets. For instance, Chinese industrial production returned to its pre-crisis levels as early as last summer whilst China’s exporters gained market share over the past year. Consequently, China’s economy is expected to grow 8.2% this year after an increase of 1.9% in 2020 while the Euro area’s growth may reach 5.2% in 2021 following a 8.3% decline last year.

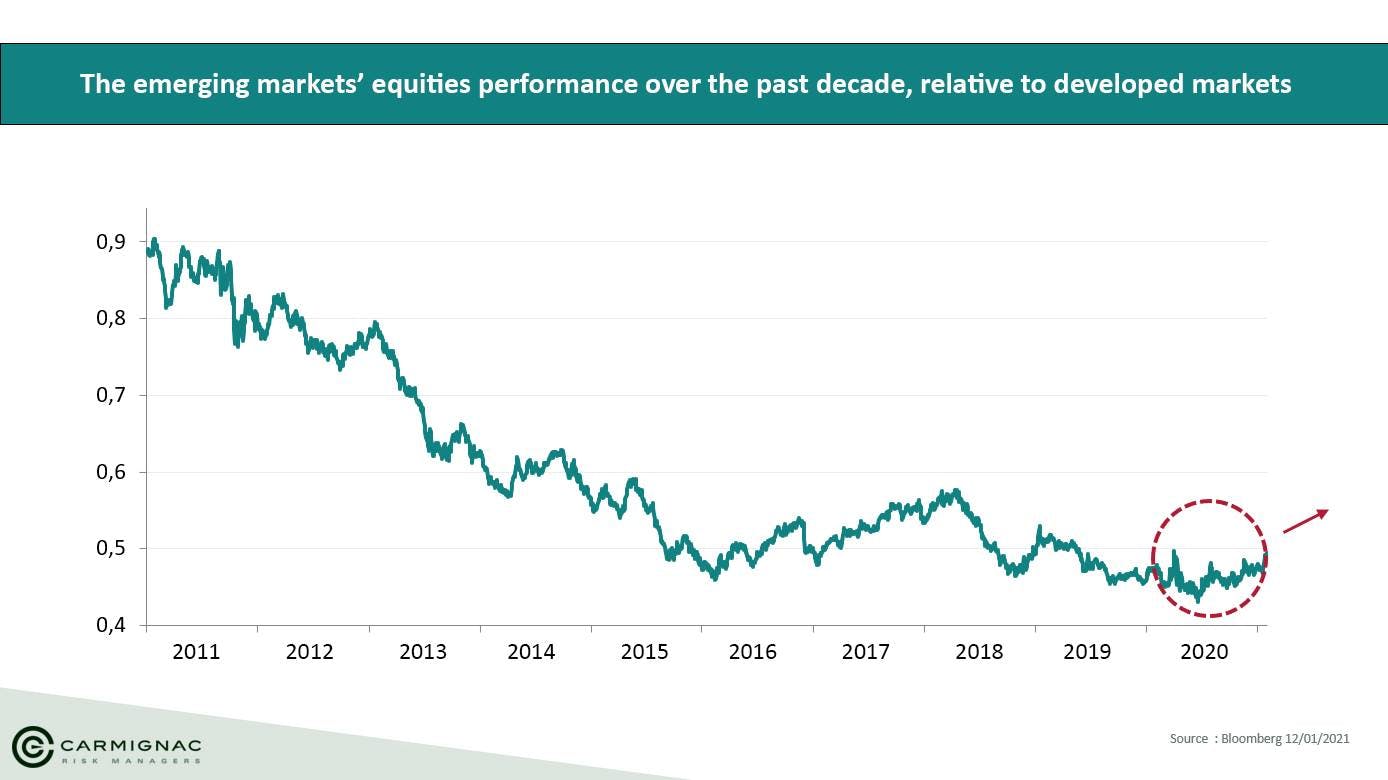

Improved economic fundamentals may help companies from emerging markets generate higher earnings and support their share prices which still need to catch up with developed markets. Whilst emerging markets’ equities gained 18%1 last year, there is still a way to go given their 10-year underperformance relative to developed markets.

Source: Bloomberg, 12/01/2021

“A big portion of the underperformance of the emerging markets’ assets was due to a strong U.S. dollar cycle. The emerging markets’ currencies depreciated against the dollar in the past few years”, explains Joseph Mouawad, emerging markets debt fund manager at Carmignac. “Now we think we’re on the brink of a major turn in dollar cycle,” he says adding the measures taken by the American government to support the U.S. economy may lead to a weaker dollar.

In addition to a favourable economic context, emerging markets, especially Asia, are at the forefront of the current technological revolution, which is accelerating due to the Covid-19 crisis. Indeed, the pandemic has forced structural changes to the way we work, the way we shop, the way we pay and even the way we entertain ourselves.

“You will find some winners of the digital revolution in the West Coast of America but there are also some, and mostly, in Asia. Asia is the biggest winner of the current industrial revolution. There are more unicorns in China today than in America. They have developed a huge ecosystem,” says Xavier Hovasse. “Asia is investing heavily in the technologies of the future. Most people in developed markets underestimate what is happening in these countries,” he underlines.

1 MSCI Emerging Markets Index