Flash Note

Correlation and diversification

- Published

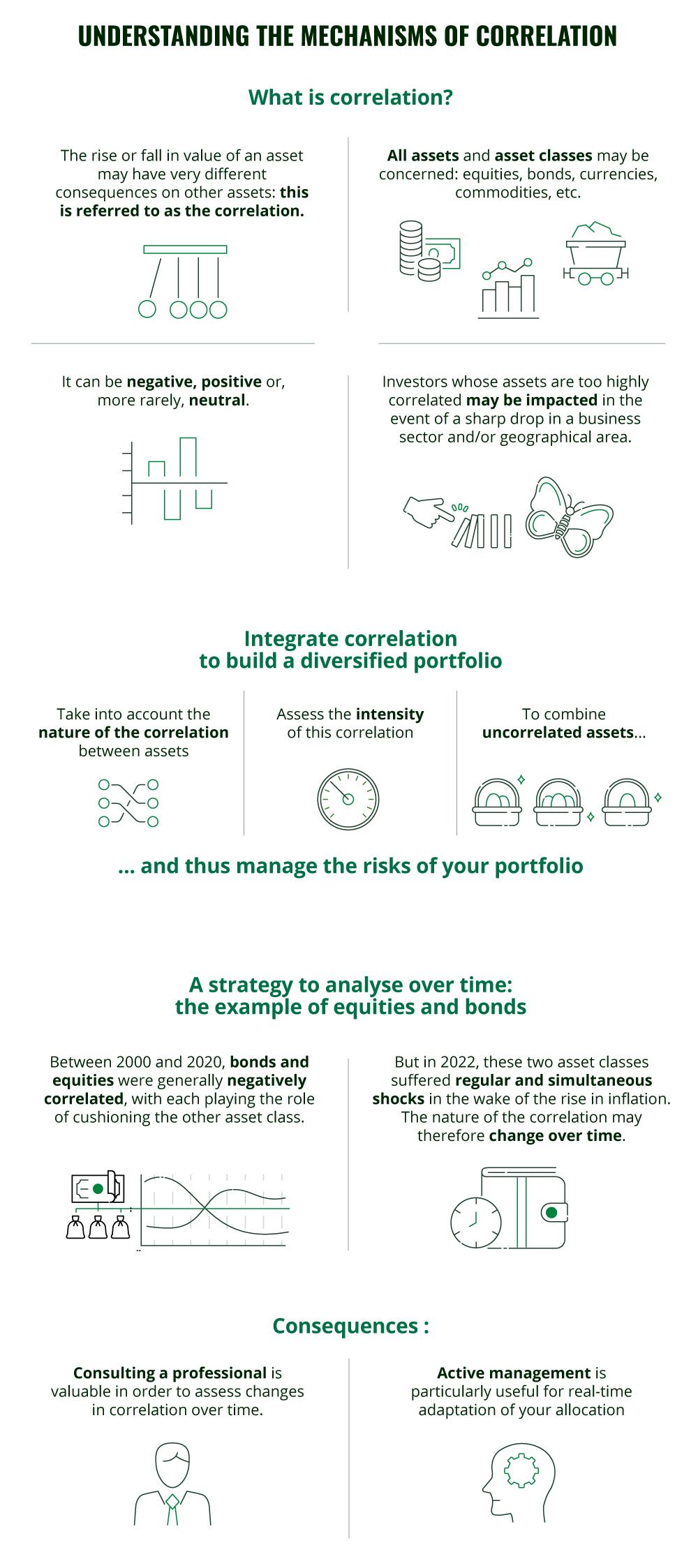

To minimise the impact of market volatility, investors must diversify their assets and choose carefully. To do this, they need to assess the correlation between financial instruments and monitor the risk of interdependence between those assets’ prices changing.

What is correlation?

Like a butterfly effect, an increase or decrease in the value of an asset can have direct and significant consequences for other assets that are, at first glance, very different.

Using correlation in a diversification strategy

Combining uncorrelated assets to diversify portfolios allows investors to reduce their exposure to the risks inherent in certain assets and smooth out fluctuations in their portfolio as a whole. This strategy enables investors to mitigate risk and therefore generate a more regular and stable performance. For example, we can mix corporate equities and sovereign bonds (government bonds) because these two asset classes are considered to be weakly, and even negatively, correlated with each other, as has largely been the case over the past 20 years.

A strategy to be analysed over time

However, correlation may change over time. It must therefore be analysed frequently. Between 2000 and 2020, bonds and equities tended to move in opposite directions, with one offsetting the other and acting as a shock absorber for the other asset class. In periods of falling stock market indices, bonds served as protection for investors’ assets. However, in 2022, stocks and bonds suffered regular and simultaneous shocks. The two major asset classes that structure the markets – equities and bonds – moved in the same direction following the inflationary wave. It is important to know how to assess what could drive correlation changes over time.

Similarly, an investor looking at the most uncorrelated share of the CAC 40 index could be tempted to buy the shares of Hermès or Veolia, which were the least correlated with the French stock market’s flagship index in 2021. However, in 2022, Thales and TotalEnergies* actually showed the best decorrelation rates with the CAC 40 index.

*Thales + 59,49% - TotalEnergies + 33,69% - Cac 40: -12 %

This shows that the use of correlation in portfolio diversification, without offering complete protection, can help limit risks by spreading investments across different assets and asset classes, such as equities, bonds, commodities, currencies, real estate, etc.