Flash Note

Could we be on the brink of a major change in environment for financial markets?

Following the Covid-19 crisis and the corresponding economic stimulus measures, the environment in which investors have been operating for the past 10 years could change dramatically in the medium term, with growth remaining weak but coupled with rising prices and higher interest rates.

The environment in which the global economy has been developing for the past decade may be entering a new phase as a result of the health crisis. This change could profoundly alter the behaviour of companies and consumers, and also that of stock market investors in the medium term, while economic growth is expected to remain weak.

The world economy has recorded sluggish growth over the past ten years, marked by stagnant prices and cuts in interest rates - with the latter in some cases becoming negative - under the impetus of the central banks which regulate economic activity. The worldwide outbreak of the Covid-19 health crisis last year led to additional measures by governments to boost the economy. These measures include financial aid to companies and, in the case of the United States, cheques of $1,200 sent directly to individuals with annual incomes under $75,000.

The various aid packages announced around the world and hopes of a return to normal life thanks to the Covid-19 vaccines have reassured investors. Since the beginning of the year, equities have gained nearly 2% worldwide, and have even jumped more than 70% since their low point in late March last year1. They have almost doubled since January 2011.

However, the prospect of an improvement in the global economy could paradoxically generate fears in the financial markets today. After stalling in 2020, the much hoped for consumer-led economic rebound this year could lead to higher prices and interest rates. Too large a rate hike could weigh on stock prices. This is what investors fear particularly for the US economy which could pick up too abruptly, with growth remaining strong beyond 2021 and requiring hasty action from the central bank to avoid overheating.

Higher interest rates mean higher costs of borrowing and consumer loans. In addition, an increase in interest rates can make equity investments less attractive to investors and savers, who are instead drawn to financial products offering higher returns such as bonds: securities that allow companies to finance themselves by borrowing money in financial markets.

Can the recovery last?

"To withstand a rise in interest rates, equities will need sufficiently strong growth in corporate financial results" explains Didier Saint-Georges, Member of Carmignac's Strategic Investment Committee. "This should be the case this year given the expected economic recovery. But how long might this recovery last?"

Last year's economic shock will certainly leave deep scars in certain sectors, such as aviation; the labour market is also very fragile and inequalities have increased further. It is also likely that the number of bankruptcies of small and medium-sized enterprises (SMEs) will increase considerably in the coming months, albeit with a time lag.

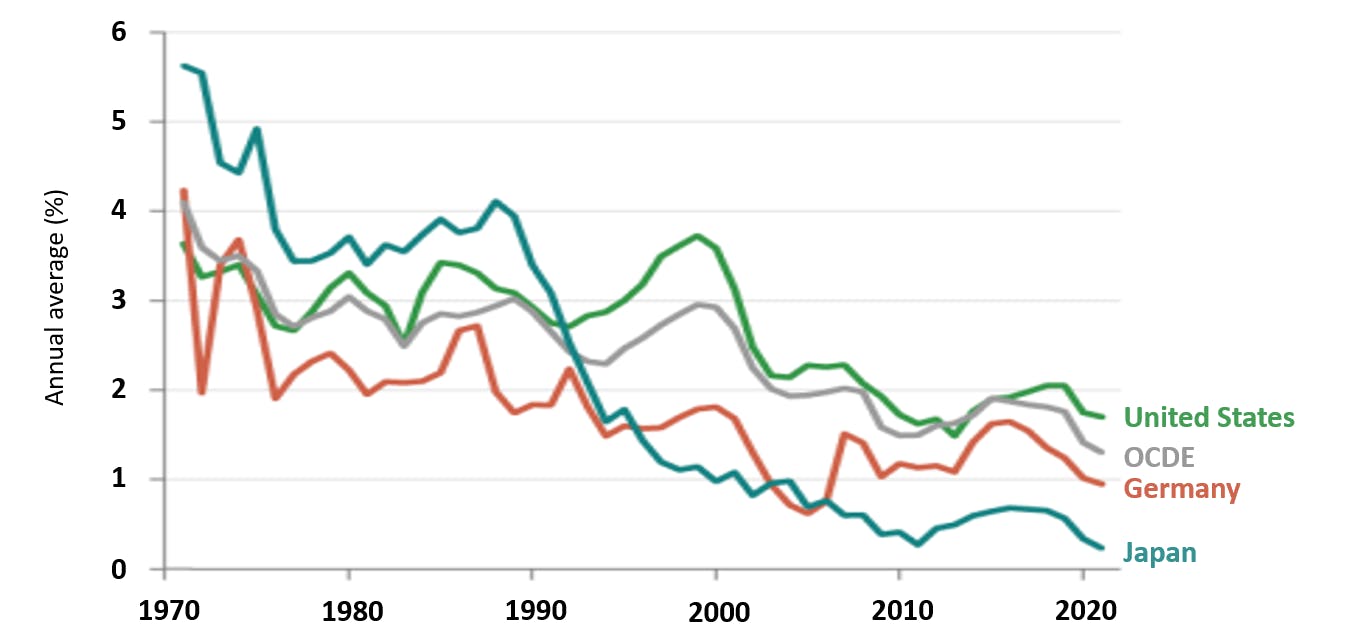

Heavily-indebted governments may also seek to raise taxes as of next year. However, the potential growth of the world economy has been declining steadily in recent decades, due to demographics, excessive debt, lack of investment, etc.

Source: Bloomberg, BIS, NBER, OECD

From February 2021

A medium-term scenario of continued weak global growth coupled with rising prices is therefore a serious possibility, which could create a challenging environment for the stock market.

"The United States is where the most instability lies, so that is where we are focusing the bulk of our risk management," emphasises Kevin Thozet, a member of Carmignac's Investment Committee, warning of the effects that a possible correction in the US financial markets could have on Europe.

For the time being, Europe presents relatively little risk of overheating, but its environment also offers limited growth potential. "This may encourage investors to pick stocks which they hope will outperform the stock market indices. This is exactly what we do in our diversified funds such as Carmignac Patrimoine and Carmignac Portfolio Patrimoine Europe," notes Kevin Thozet.

China, on the other hand, looks to be a healthy investment area. China's exports benefited greatly last year from support plans in the US and Europe, and the country is set to benefit from the global recovery. Moreover, price rises there are very modest. And unlike other countries, China still has room to lower interest rates if necessary.

“In this context, we continue to adopt a "barbell" strategy, which consists in investing simultaneously in assets with opposite risk profiles”, explains Gergely Majoros, a member of Carmignac’s Investment Committee. "We are investing both in stocks where we expect strong long-term growth and visibility, with a significant portion in China, and also stocks that should benefit from the reopening of the economy in the shorter term."

Carmignac Patrimoine E EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.

Carmignac Portfolio Patrimoine Europe A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.

1Performance of the MSCI ACWI World Index in US dollars as of 05/03/2021

2Benchmark: 50% MSCI AC World NR (USD) (net dividends reinvested), 50% ICE BofA Global Government Index (USD) (coupons reinvested) Rebalanced quarterly. Until 31/12/2020 the bond index was the FTSE Citigroup WGBI All Maturities Eur. Source: Carmignac at 05/03/2021.

3Benchmark: 50% Stoxx Europe 600 (net dividends reinvested), 50% BofA Merrill Lynch All Maturity All Euro Government. Rebalanced quarterly. Source: Carmignac: at 05/03/2021