Flash Note

Five reasons to retain an interest in fintechs

- Published

-

Length

3 minute(s) read

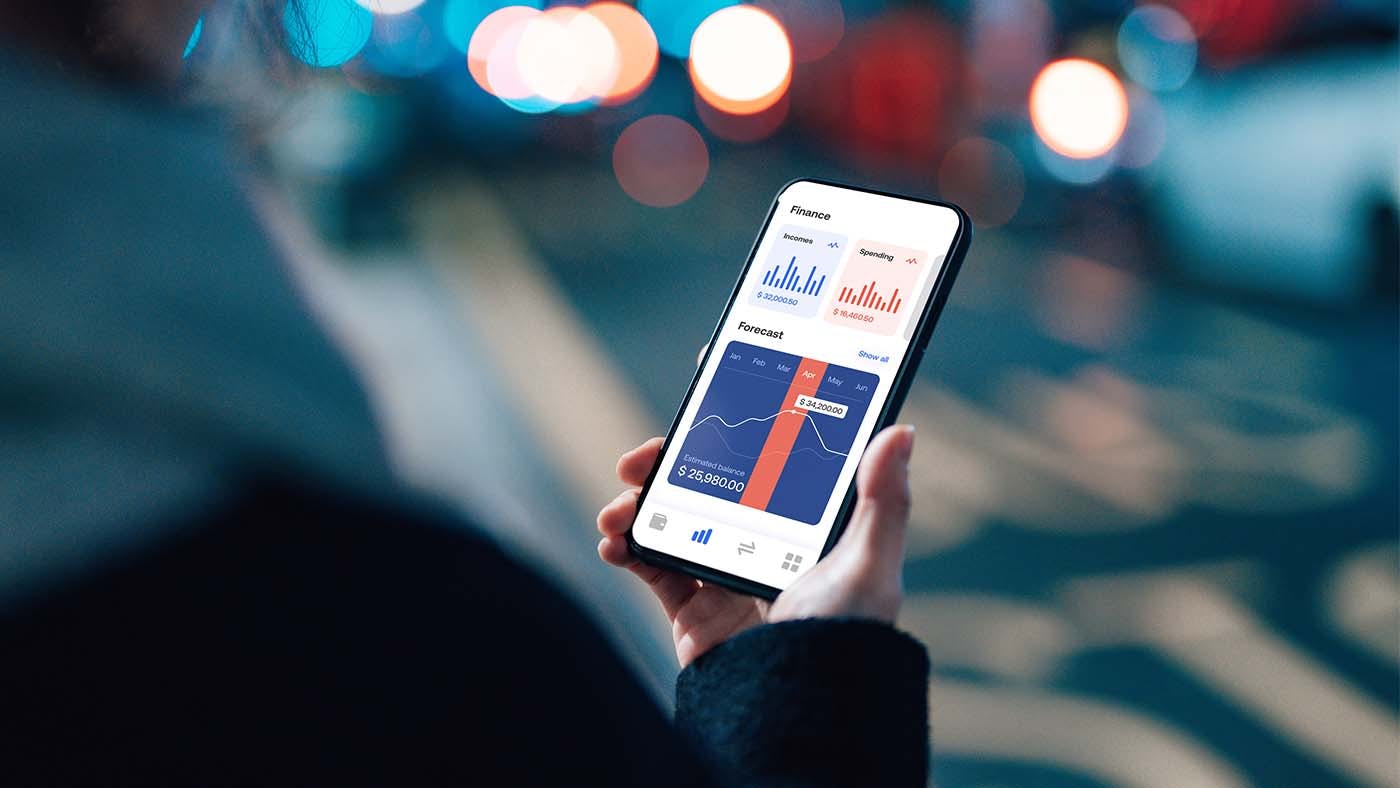

A real driving force behind the current digital revolution, fintechs1 – a portmanteau of “finance” and “technology” that emerged a few years ago – did not have to wait for the COVID-19 crisis before experiencing very strong growth. This trend is likely to continue over the coming years given the digital shift of consumers.

Pushed to the forefront during the health crisis, fintech services – from online payments to loans – benefitted from the search for contactless solutions and transactions that could be carried out remotely. While these services existed before the pandemic, COVID-19 has accelerated the acquisition of new habits and completely changed consumer behaviour.

Consequently, the global fintech market should grow by an average of nearly 27% per annum between 2020 and 2026, according to one recent study: The Global FinTech Market Report 2021.

Such prospects have not failed to attract investors. According to the Boston Consulting Group, investment in fintechs surged by 173% between the third quarters of 2020 and 2021. Stocks in these companies have been very popular over the past three years.

Stoxx Global Fintech, Stoxx Global 3000 Banks and Stoxx Global 1800 indices

However, fintechs may still hold potential as some industry players are managing to gain considerable market share given their great flexibility and the cutting-edge technologies that they use.

Here are five reasons why we think you should keep a close eye on fintechs:

1Fintechs are technology companies that rival traditional banking and financial institutions, offering new financial services.

2Offer allowing clients to pay for items in several instalments, for example over a period of six weeks. These loans are generally taken out at zero percent interest.

3Virtual means of payment used essentially on the Internet, based on cryptography – encryption guaranteeing the inviolability of data – to secure transactions and the creation of units, while avoiding any control from regulators and central banks.