Flash Note

Takeaways from the 2023 voting season

For active owners like Carmignac, the Annual General Meeting (AGM) season represents an opportunity to make our voices heard through voting and often represents the culmination of a busy period of engagement. Voting is an essential tool in our stewardship programme. It gives us an opportunity to encourage our investee companies to make improvements aligned with ESG best practices which are in the long-term interests of the company, their stakeholders and ultimately our clients.

In the interest of transparency, at the end of the voting period, we would like to share our highlights and report how we voted at the shareholder meetings of our investee companies.

We use our votes to signal concerns to the boards of the companies we are invested in but our active ownership activity does not stop here: engagement, or dialogue with companies, is how we seek to influence change and complements our voting activity. For more information on our approach to engagement, please consult our Engagement Policy1 .

Votes against companies not meeting our ESG voting guidelines

During this voting season, Carmignac cast at least one vote against management at 54% of the meetings in which we voted2. This represents a total of 9% votes cast against the management of the companies we invest in, versus 12% over the same period in 2022.

This voting season also marked a milestone for Carmignac. In January 2023 we published our inaugural ESG expectations. We set out our expectations as an active asset manager for our investee companies (equity and bond holdings) around three priority themes: Climate, Empowerment and Leadership.

This heavily influenced our voting this year, for example:

The absence of auditor rotation triggered votes against 13% of auditor-related resolutions.

Concerns on executive remuneration triggered votes against 15% of remuneration resolutions and 7 votes against the chairs of remuneration committees as per our vote escalation strategy.

We cast 25 votes against the election of directors because of concerns over the level of board gender diversity.

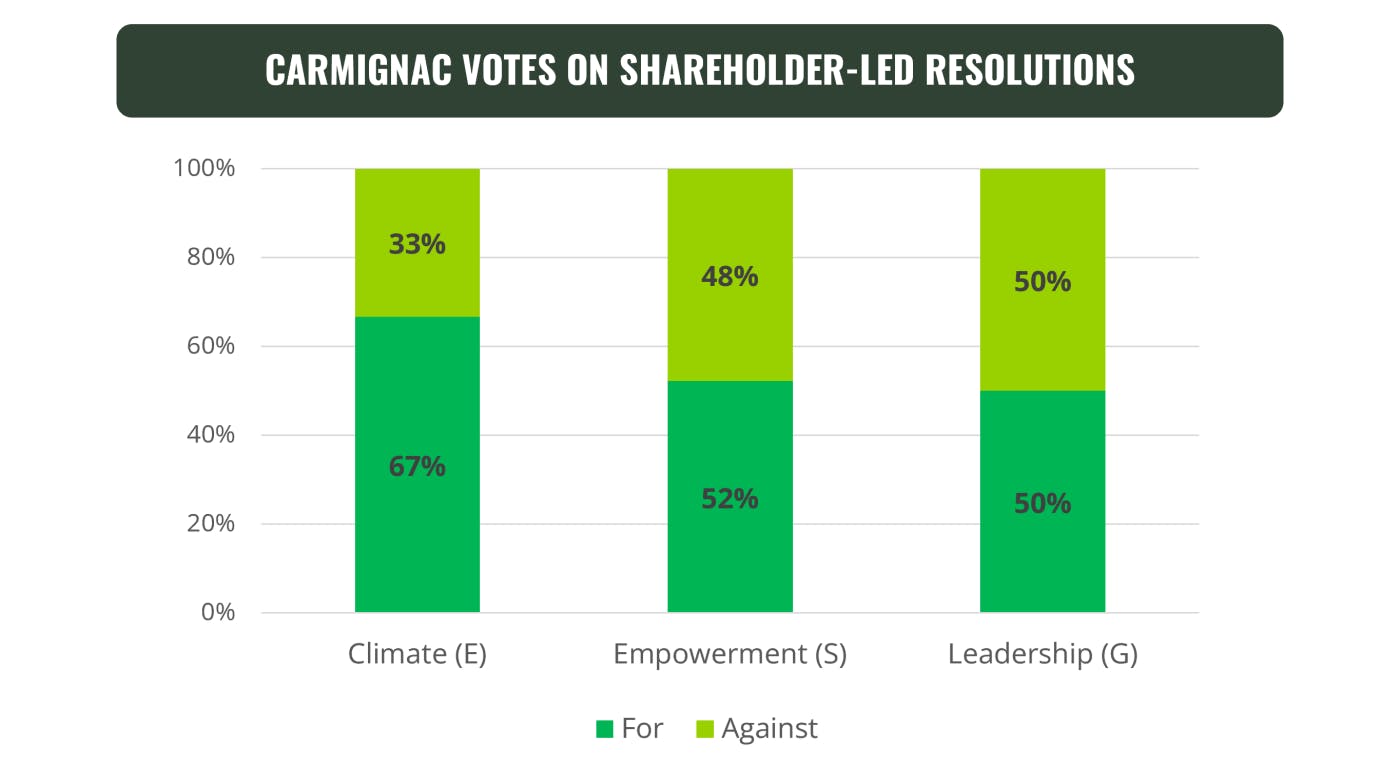

We continue to believe that the filling of resolutions by shareholders is a fundamental tool in ensuring minority shareholders can hold boards to account. However, Carmignac takes a case-by-case approach to voting on these resolutions. Given the record increase in resolutions filled by shareholders, we believe the most appropriate approach is to ensure we only support resolutions which tackle relevant issues, are not overly prescriptive or burdensome, and are genuinely constructive on ESG issues.

A significant level of support, above 30%, for a shareholder-led resolution, sends a strong signal to the board that shareholders expect more action on a specific issue and is often the only means by which minority shareholders can communicate this. This is especially the case in companies with a shareholder that holds a controlling stake.

We also noted difficulties around the quality of some of the resolutions filed by shareholders. We especially noticed an increased number of “anti-ESG” resolutions. These are typically filed in the US by proponents who have concerns about the increased level of ESG considerations by companies and tend to promote a US conservative political agenda. For example, we voted against a resolution from the National Center for Public Policy Research requesting pharmaceutical company Eli Lilly to report on the risks of supporting abortion4 .

A closer look at our voting activity: significant votes

We highlight below significant votes during the 2023 voting season, split around our three ESG themes of focus:

1https://carmidoc.carmignac.com/ESGEP_INT_en.pdf

2The votes we refer to in this article refer to all our votes across our two legal entities: Carmignac Gestion and Carmignac Gestion Luxembourg. Data is based on Carmignac calculations using data stored in ISS ProxyExchange.

3https://insights.issgovernance.com/posts/us-shareholder-proposals-jump-to-a-new-record-in-2023/.

4Eli Lilly AGM 1st May 2023, resolution 10 - Report on Risks of Supporting Abortion: «Shareholders request the Company issue a public report prior to December 31, 2023, omitting confidential and privileged information and at a reasonable expense, detailing the known and reasonably foreseeable risks and costs to the Company caused by opposing or otherwise altering Company policy in response to enacted or proposed state policies regulating abortion, and detailing any strategies beyond litigation and legal compliance that the Company may deploy to minimize or mitigate these risks».

5Resolution 13 - Approve 2022 Climate Report, Glencore AGM 26th May 2023.

6Resolution 19 – Resolution in Respect of the Next Climate Action Transition Plan, Glencore AGM 26th May 2023.

7Source: https://www.glencore.com/media-and-insights/news/results-of-2023-agm.

8Resolution 14 – Approve the Company’s Sustainable Development and Energy Transition Plan, TotalEnergies AGM 26th May 2023

9Resolution A – Align Targets for Indirect Scope 3 Emissions with the Paris Climate Agreement (Advisory), TotalEnergies AGM 26th May 2023.

10To limit global warming to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C.

11Source: https://totalenergies.com/sites/g/files/nytnzq121/files/documents/2023-05/AG2023_Resultats-des-votes-par-resolution_EN.pdf.

12AGM held on 24th May 2023.

13Source:https://ir.aboutamazon.com/sec-filings/default.aspx

14Resolution 4 - Approve Recapitalization Plan for all Stock to Have One-vote per Share, Meta Platforms AGM 31st May 2023.

15Resolution 18 – Approve Recapitalization Plan for all Stock to Have One-vote per Share, Alphabet AGM 2nd June 2023.

16Source : https://www.sec.gov/ix?doc=/Archives/edgar/data/1326801/000132680123000083/meta-20230531.htm.

17Source: https://abc.xyz/investor/other/annual-meeting/#:~:text=The%20ratification%20of%20the%20appointment,votes%20against%2C%20and%2019%2C606%2C676%20abstentions