Corporate News

![[Header] [About us] [SRI] Socially Responsible Investment [Header] [About us] [SRI] Socially Responsible Investment](https://carmignac.imgix.net/uploads/article/0001/04/80df5bab68717c350f1a29bc6b9179c12b3ffbb4.jpeg?auto=format%2Ccompress)

Excellent PRI scores for Carmignac

- Published

-

Length

1 minute(s) read

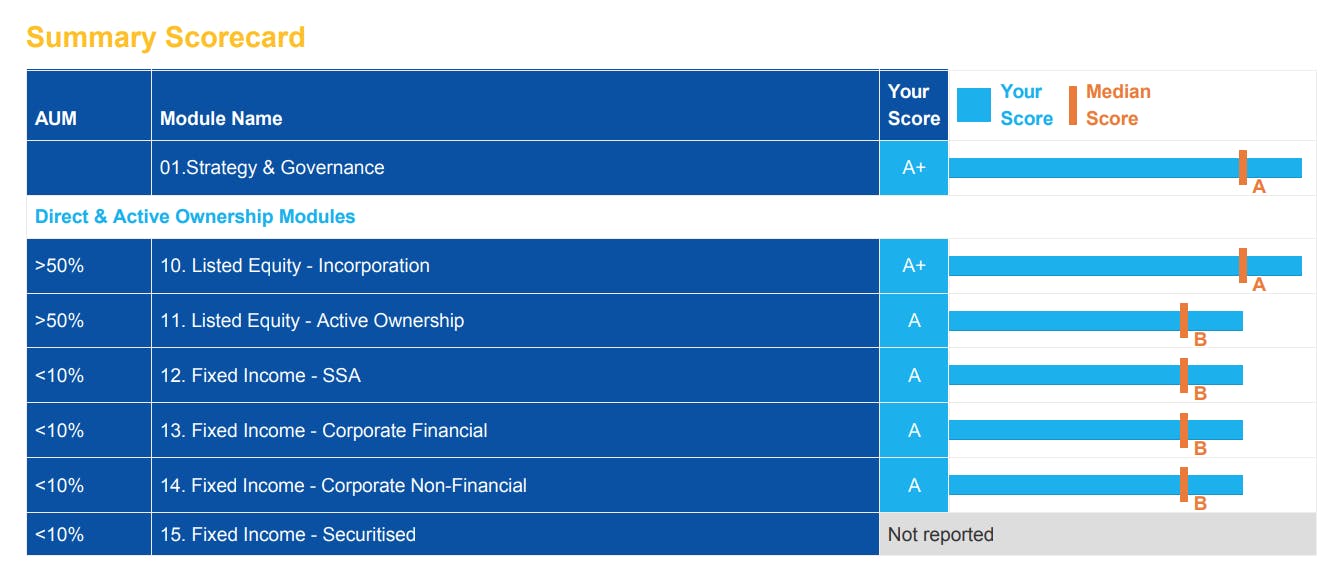

The PRI (Principles for Responsible Investment) initiative acknowledges the strengths of Carmignac’s responsible investment policy based on the scorecard from its 2020 Assessment Report.

The PRI are a set of principles whose aim is to provide a global framework for investors to consider environmental, social and governance (ESG) issues in their investment decisions. Launched in 2006 and supported by the United Nations (UN), the PRI encourage responsible investment practices across the financial industry for all stakeholders, to achieve a more sustainable financial system.

As signatory, Carmignac commits to comply and promote these principles. Each year, its responsible investment policy is subject to a thorough assessment from the PRI. For 2020, Carmignac receives A+ – the highest score – for the “Strategy and Governance” and “Listed Equity - Incorporation” modules. It also scores A (superior to the B median score) for “Listed Equity – Active ownership”, “Fixed Income – Government bonds (SSA)”, “Fixed Income – Corporate Financial” and “Fixed Income – Corporate non-financial”.