Flash Note

Family businesses in five charts

- Published

-

Length

4 minute(s) read

Do family businesses deliver better stock-market performance than other companies? If so, why? What ownership breakdown is most effective, and does business performance change over generations? Should we look to developed or emerging markets for the best-run family firms? These are all questions that you may have to answer if you’re thinking about investing in a family owned and/or managed company.

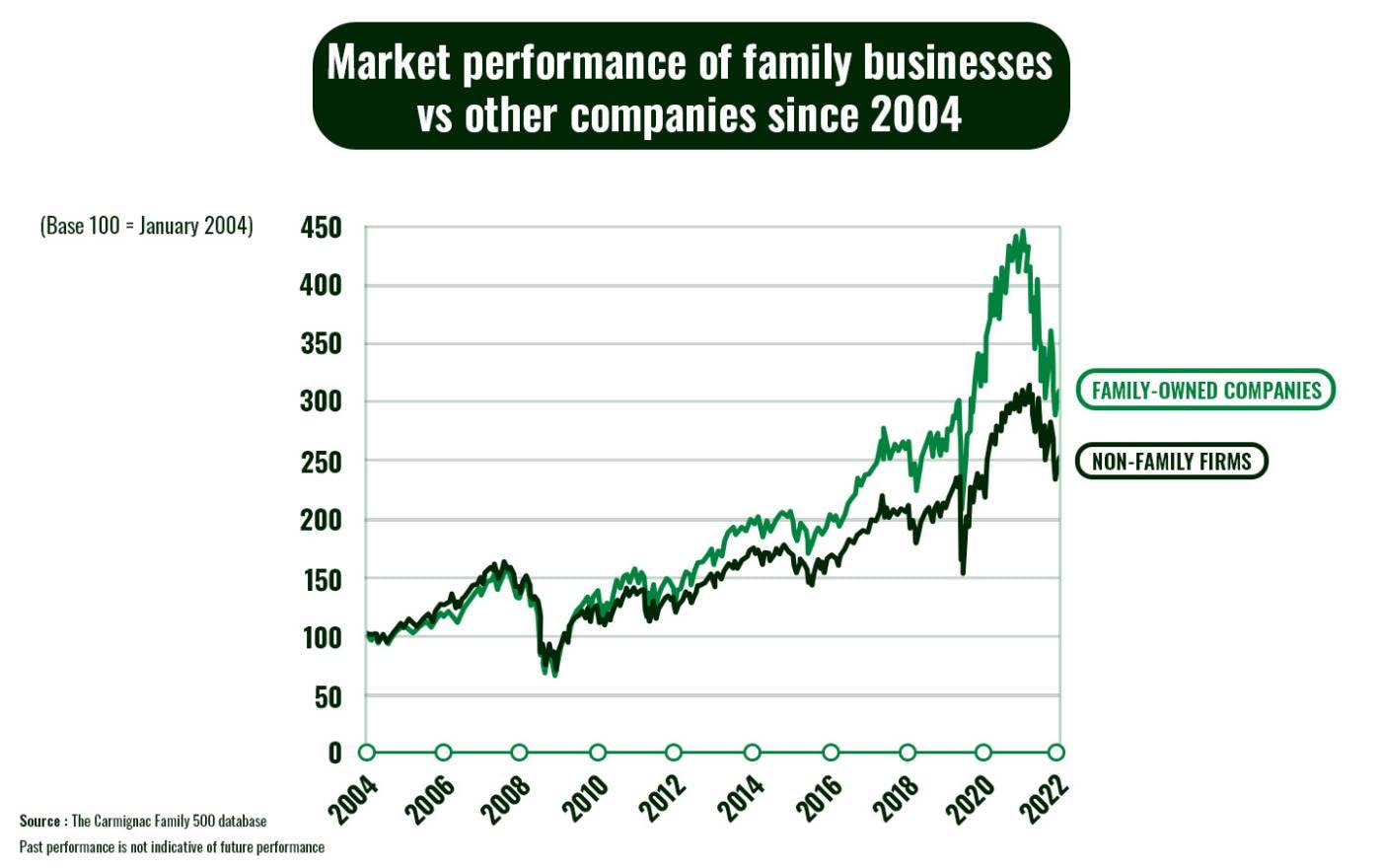

1) Do family businesses outperform in the stock market?

According to our Carmignac Family 500 database, an investment made in January 2004 in a family business would have almost tripled by January 2022 at an average annual growth rate of 10.2%, compared to a 2.5-fold increase for an identical investment in a non-family business at an average annual growth rate of 7.9%.

Reasons for this outperformance include: skin in the game1, a longer-term investment horizon and higher risk aversion. Family businesses are generally run with a long-term view based on earnings growth and profit-margin stability. As they invest their own money in their business, managers of family firms also tend to be more risk-averse. Founding families usually play a large role in business decisions, with a view to preserving family wealth and passing the company on to their children and grandchildren.

Family businesses are also characterised by:

- Lower leverage – Family firms have lower net debt-to-EBITDA ratios: -0.07, versus 0.9 for non-family companies (equal to about one year of debt service costs). This indicates that family firms generate relatively more cash.

- Higher returns – The return on equity (ROE) for family businesses was 15.1% at the end-of October 2022, and the return on invested capital (ROIC) was 10%. But the equivalent figures for non-family companies were lower: 13% (ROE) and 8.4% (ROIC). This shows that family businesses tend to be managed more efficiently.

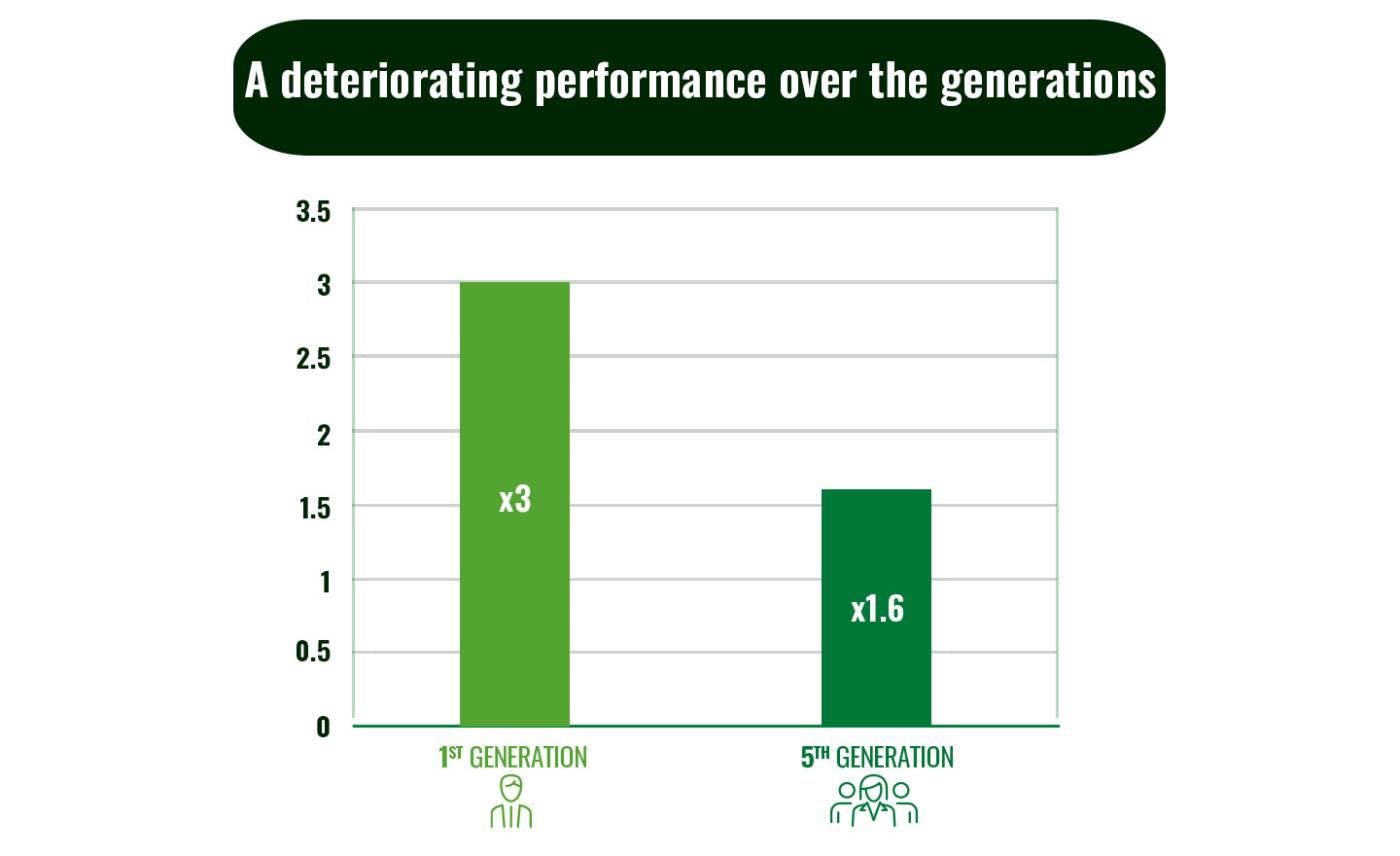

2) Does stock market performance change with later generations?

When it comes to family wealth, there’s an old adage that says: "The first generation builds, the second generation expands, and the third generation squanders." Is that true for family businesses, too?

There’s evidence that stock-price appreciation tends to decline as younger generations take over the firm. Over the period from January 2004 to October 2022, the stocks of companies run by the first generation gained almost twice as much as those run by the fifth generation.

Part of this reflects the heavy investment needed to adapt and keep growing a company as it ages. In addition, the managers of family firms pay close attention to risk/return trade-offs when investing and think carefully about how to best deploy capital over the long term so as to meet their key business needs – i.e. “patient capital” – which can weigh on stock-market performance.

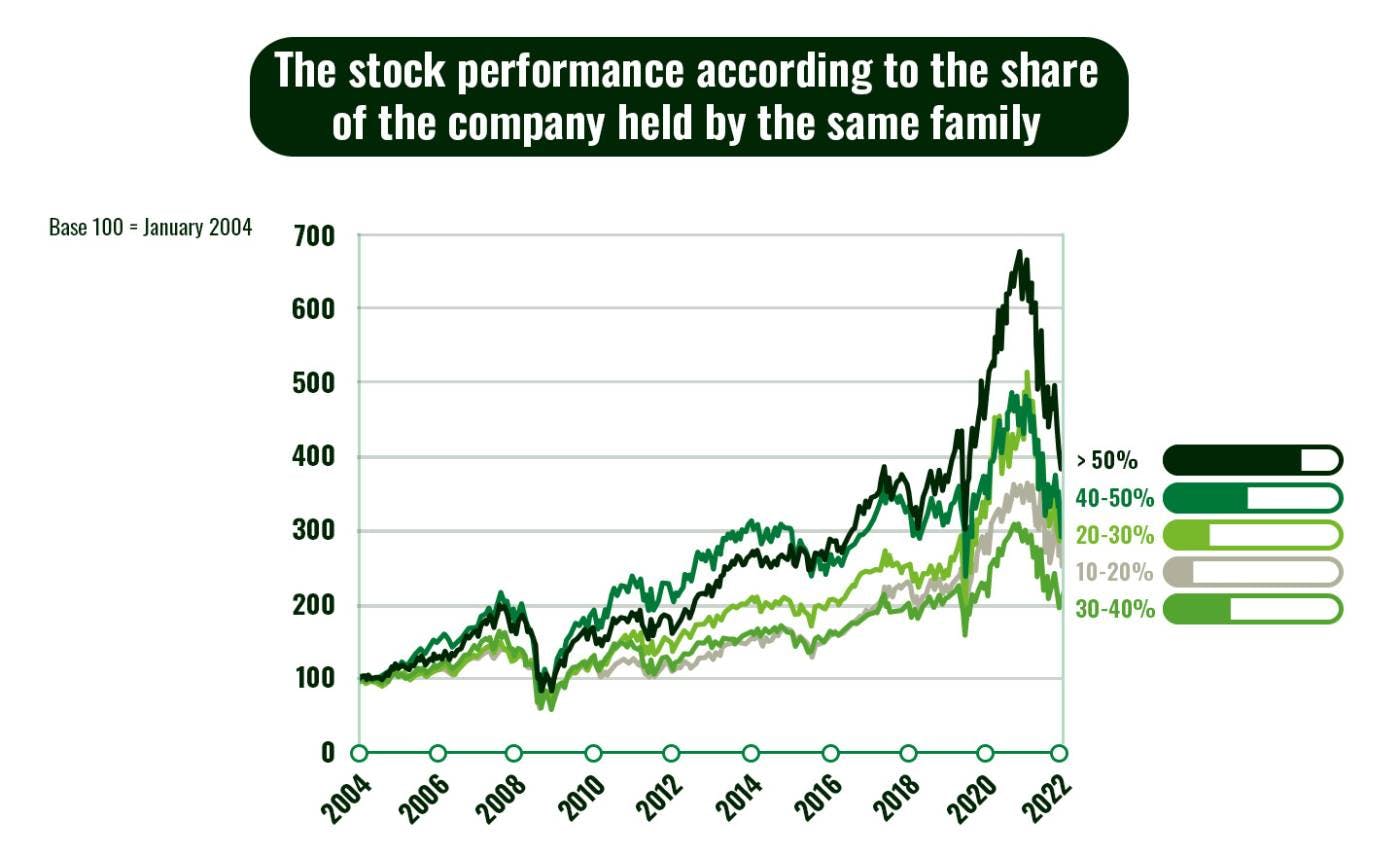

3) What’s the most effective ownership breakdown?

Looking again at the period from January 2004 to October 2022, the stocks of businesses that are more than 50%-owned by the founding family post much higher gains than companies with lower family stakes. This is largely due to better alignment between the interests of shareholders and management. Such majority-owned businesses are also less subject to the demands of minority shareholders whose interests may not be consistent with those of management and/or the company's long-term goals.

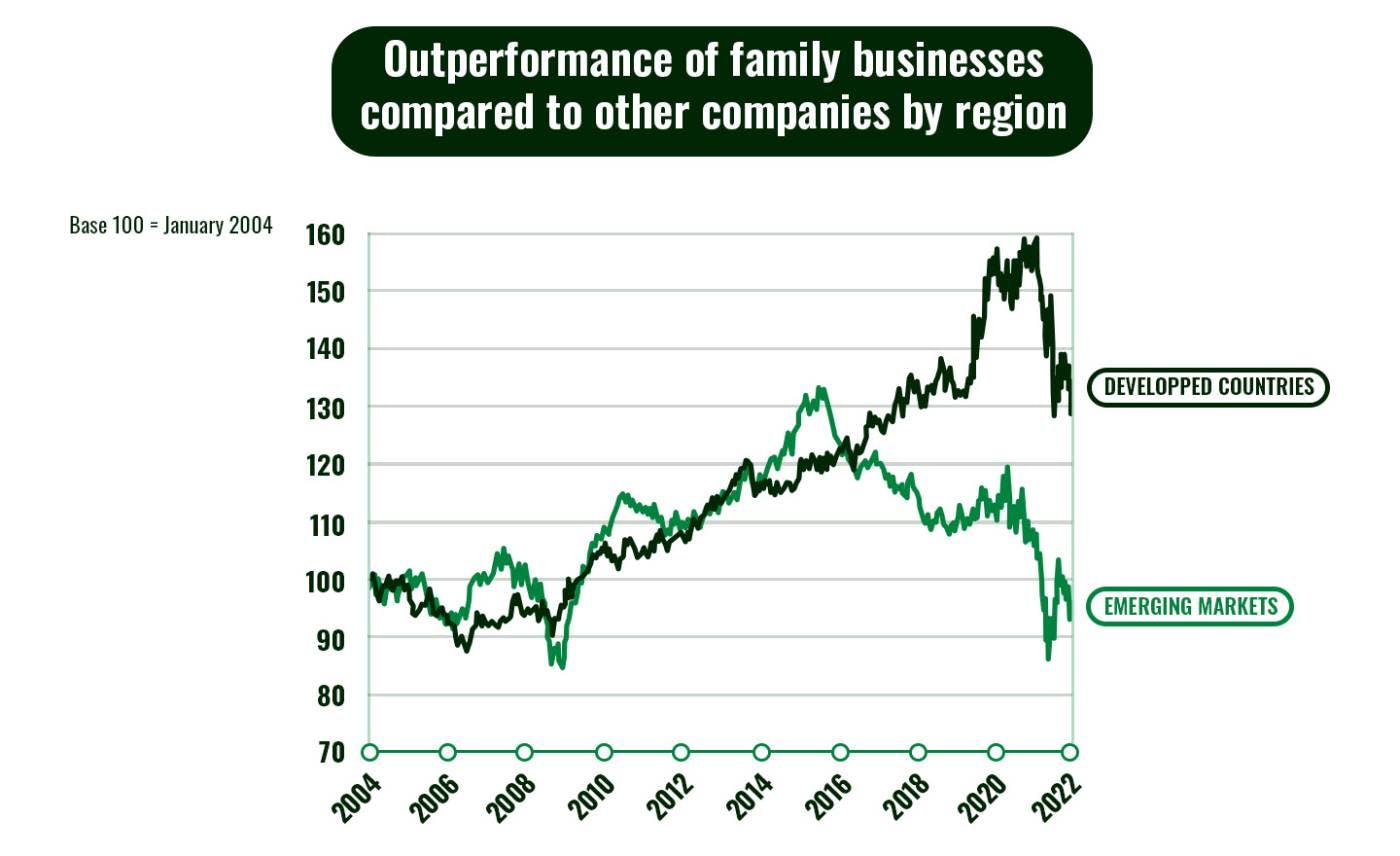

4) Where are the best-performing family businesses found?

Family businesses generally outperform non-family businesses by a greater extent in developed countries than in emerging ones. This can be attributed to better corporate governance – an issue that’s increasingly important to investors – in the developed world. In addition, stock prices in emerging markets tend to be more volatile and show wider dispersion in returns, owing mainly to the higher risk premiums.

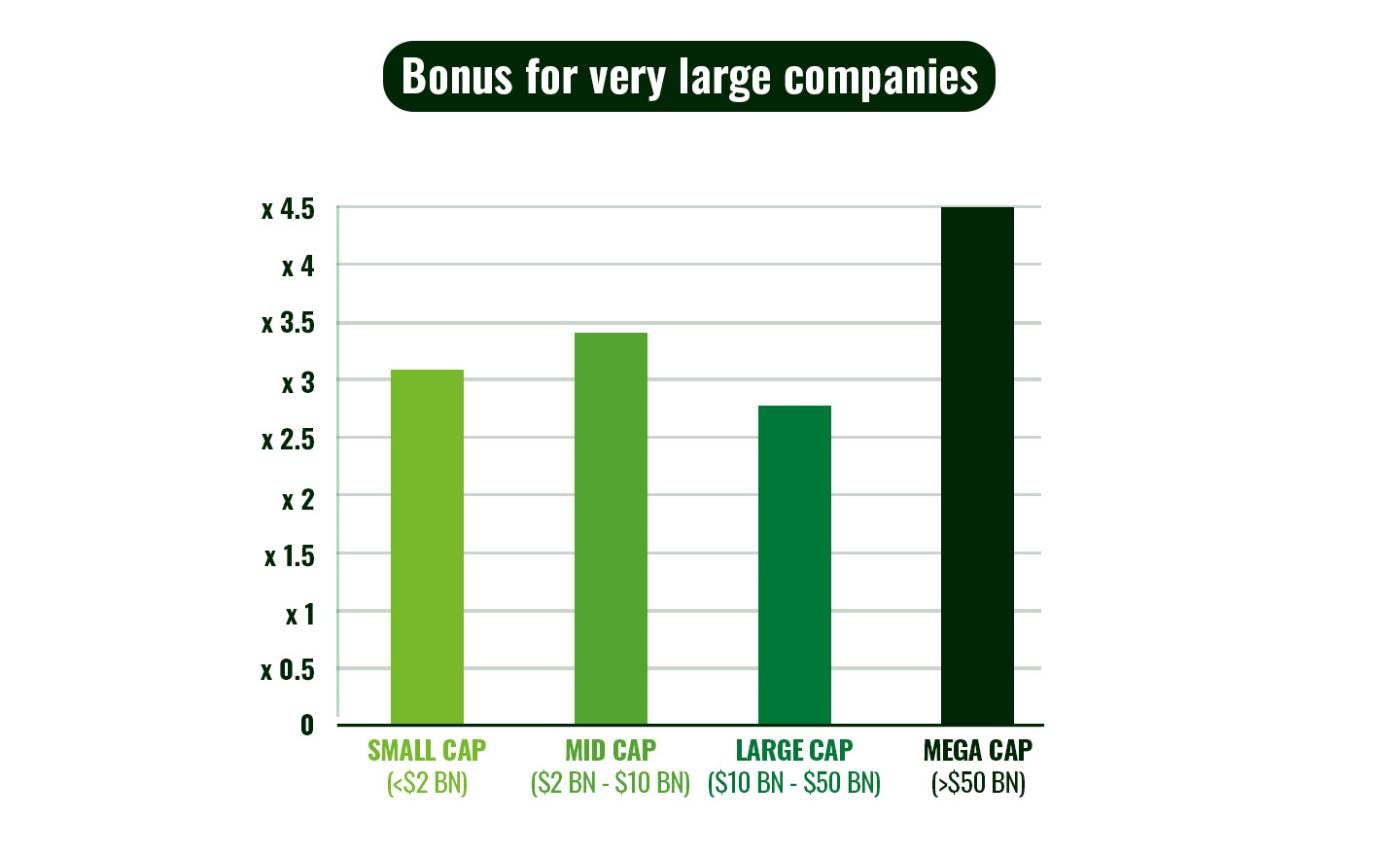

5) Do large or small family businesses perform better?

According to our Carmignac Family 500 database, an investment made in a mega-cap family business (with a market value of >$50 billion) in January 2004 would have been multiplied by 4.5 by the end-of October 2002. The same investment in a large-cap family business (market value of $10 billion to $50 billion) would have increased by a factor of 2.8 in October 2022, compared with a multiple of 3.4 for mid-caps (market value of $2 billion to $10 billion) and 3.1 for small caps (market value of <$2 billion).

Very large companies are often more mature, meaning they generate less volatile returns, even in times of crisis. They also have deeper pockets and can achieve greater stability in profit margins and earnings. On the other hand, small companies are more vulnerable to market shocks and have less bargaining power for negotiating the interest rates on their loans, resulting in a relatively higher cost of capital.

Small companies tend to be more agile with higher growth potential, but large companies offer greater stability in business development. Large companies are also more likely to be sector leaders.

While these are all probing facts, caution is needed before jumping to conclusions. There are many large family businesses out there that tick all the boxes – majority-owned by their founders, run by the first generation, and listed in a developed country – but not all of them necessarily make for a successful investment.

The reality is much more complex, and many other factors need to be taken into account: a company’s governance, sector, and specific circumstances, for example. Before selecting a family business to invest in, you should perform further analyses and meet with its management team; it’s also worth considering where the economy is in the business and market cycle.

That’s why it may be preferable to call on professional asset managers with the expertise to carefully study and assess family businesses – a market segment that can make for a promising addition to your portfolio.

1The term "skin in the game" refers to a situation in which the managers of a company use their own money to invest in their business

Sources : Carmignac, Carmignac Family 500 database, October 2022