Flash Note

Making a difference through emerging markets

-

Length

6 minute(s) read

Investing in emerging markets reflects an ambition that goes well beyond simple financial performance targets. By definition, investing in this universe is a way to support the social and environmental advancement of developing nations.

Carmignac has spent over 30 years establishing a reputation as an EM player through our sustainable approach.

Carmignac – a pioneer in emerging markets

When Carmignac was founded in 1989, we became one of the first players to invest in emerging markets.

Over the years, we have successfully developed a unique and distinctive approach in order to detect market opportunities. This has allowed us to build up solid expertise in the EM universe, as can be seen in the development of a specialised fund range equipped with both new performance drivers and enhanced diversification, active across all asset classes.

This track record and the trust of our partners have seen our EM range grow to almost EUR 7 billion in assets under management1 .

Our ESG positioning

We view adopting environmental, social and governance criteria as an essential part of appropriately managing risk in light of the financial implications of ESG matters.

Moreover, we believe it is our responsibility to make a positive contribution to society and the environment over the long term and to prioritise adding value for our clients. That’s why we have always incorporated ESG considerations into our analyses. We have never invested in the tobacco or weapons sectors, for example.

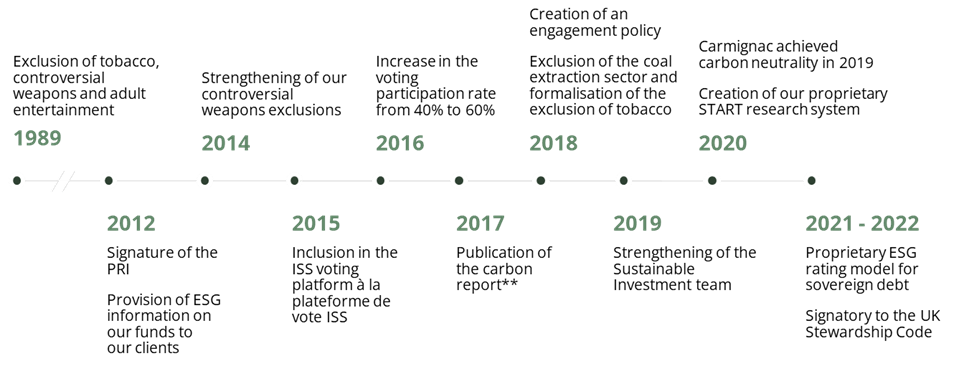

However, we have strengthened our approach* and formalised our sustainable investment philosophy in recent years:

Source: Carmignac, December 2022. * Not all funds and issuers are covered by this statement. For further details, please refer to: https://www.carmignac.fr/en_GB/responsible-investment/snapshot-4742. ** In response to article 173 of the French energy transition law.

As an independent investor with strong convictions, we have decided to concentrate on three major ESG themes that are aligned with Carmignac’s core identity: climate, empowerment and leadership. Today, over 90%2 of our AUM are designated as article 8 or 9 under the SFDR3.

How our EM convictions reflect our sustainable approach

Our approach to emerging markets reflects our determination to invest sustainably. Our management teams seek to fully understand the risks inherent in emerging countries by combining analysis of fundamentals with consideration of non-financial criteria. We take care to examine the macroeconomic fundamentals of each security and carry out site visits to ensure a thorough investigation, and we also rely on a proprietary ESG analysis tool called START4 . This tool, which is at the heart of our process, allows us to offer unique human insight and engage companies in dialogue about key indicators.

In addition to this preliminary stage, we have also used specific approaches to take our sustainability efforts one step further. Within our EM equities funds, for example, we ensure we are having a positive impact on society and the environment through measures such as aligning ourselves with the Sustainable Development Goals (SDG) defined by the United Nations. Several SDG are particularly relevant for emerging countries. Challenges such as “No poverty”, “Zero hunger” and even “Affordable and clean energy” have often already been met within developed countries.

For our EM fixed-income investments, we have taken steps such as introducing a proprietary ESG rating tool for sovereign debt, along with a specific model for EM debt. Our dynamic analysis therefore allows us to assess developing countries’ positive trajectory in relation to the E, S and G pillars as well as the inherent risks. For each pillar, we focus on qualitative data such as the share of renewable energy for the environment pillar, GDP per capita for the social pillar and human rights for the governance pillar.

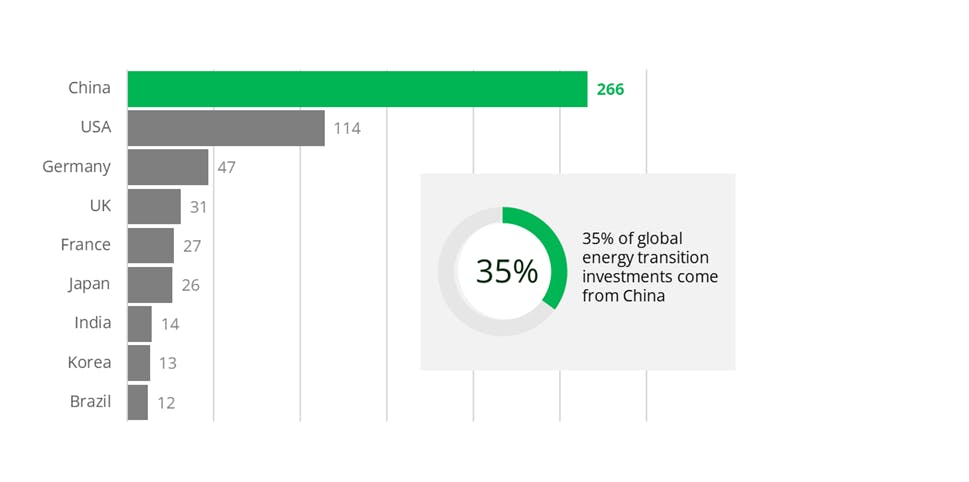

We are also convinced that emerging markets have a decisive role to play in responsible investment. The energy transition cannot happen without emerging countries, and nations including China, South Korea and India have emerged as major players in the fields of innovation and green technology.

Investment in the energy transition in 2021 (USD bn)

Source: Carmignac, BNEF, Bloomberg 31/12/2021

At Carmignac, we have combined our position as an EM pioneer with our ESG approach to offer complementary and sustainable investment solutions:

-

Carmignac Emergents

Equity strategies

Grasping promising opportunities in the EM universe through a sustainable approach

-

Carmignac Portfolio China New Economy

Equity strategies

Seize the growth potential of China’s new economy

-

Carmignac Portfolio EM Debt

Fixed income strategies

Seizing opportunities on the EM fixed-income markets while retaining flexibility

-

Carmignac Portfolio Emerging Patrimoine

Diversified strategies

An all-inclusive, sustainable EM solution

Investing in emerging markets therefore represents not only a source of performance and diversification, but also an opportunity to invest sustainably.

1Source: Carmignac as at 31/01/2023.

2Source: Carmignac as at 31/01/2023

3The SFDR (Sustainable Finance Disclosure Regulation) 2019/2088 is an EU regulation that requires asset managers to sort their funds into categories including: “Article 8” for funds that promote environmental and social characteristics, “Article 9” for those that engage in sustainable investment with measurable objectives, and “Article 6” for funds that do not necessarily have a sustainability objective. For more information, visit: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=en.

4The exclusive START ESG system combines and aggregates ESG indicators from the main suppliers of market data. It is not possible to take all relevant indicators into consideration owing to a lack of standardisation and insufficient reporting of certain ESG indicators by listed companies. START provides a centralised system through which Carmignac delivers its analyses and insights into each business assessed, even if the external data it has aggregated is incomplete. For more information, please refer to the ESG integration policy on our website: https://carmidoc.carmignac.com/SRIIP_FR_en.pdf

Carmignac Emergents A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Carmignac Portfolio China New Economy A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

LIQUIDITY: Temporary market distortions may have an impact on the pricing conditions under which the Fund might be caused to liquidate, initiate or modify its positions.

The Fund presents a risk of loss of capital.

Carmignac Portfolio EM Debt A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

CREDIT: Credit risk is the risk that the issuer may default.

The Fund presents a risk of loss of capital.

Carmignac Portfolio Emerging Patrimoine A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

The Fund presents a risk of loss of capital.