Flash Note

The main convictions of Carmignac Portfolio Global Bond

- Published

-

Length

7 minute(s) read

The current environment, characterized by rising interest rates, high inflation and increasing geopolitical risks, is a major challenge for most bond investors. In this context, and in order to navigate on this new geopolitical and monetary order, it is therefore crucial to have the ability to invest across all fixed income and currencies assets.

Investment Philosophy & Key Selling points

We believe that Carmignac P. Global Bond has the tools to meet these macro-economic and financial challenges, notably through:

-

- A global investment universe that allows us to identify macro-economic trends around the world. This allows us to invest in all geographical areas and to take advantage of any macroeconomic asynchrony across all eligible assets.

- A multitude of alpha sources across all bond sub-sectors, including interest rates, credit and currency strategies in both developed and emerging markets.

- A flexible and unconstrained investment process that aims to "cross the cycles" that employs both long and short strategies to optimize performance while mitigating risk in all market conditions, enabling us to meet our clients' current challenges.

- A global investment universe that allows us to identify macro-economic trends around the world. This allows us to invest in all geographical areas and to take advantage of any macroeconomic asynchrony across all eligible assets.

As a reminder, our main investment guidelines are as follows:

- Modified duration: -4 to 10.

- Structured credit exposure: 0 to 10%.

- Credit derivatives: 0% to 30% (on iTraxx and CDX indices).

- FX: FX strategies can be either a performance driver or a risk management tool.

Finally, the fund's Portfolio Manager, relies on the contributions of the entire Fixed Income investment professionals’ team at Carmignac, which is composed of around 20 people, including analysts, economists and portfolio managers.

Current macro-economic trends

As geopolitical risks become more and more localized, we observe the resurfacing of the challenges which the global economy was already facing before the escalation of the Ukraine-Russia war.

At a glance, in the face of increased, persistent and widespread inflation, hawkish central bankers, rising yields, slowing global growth and geopolitical uncertainties the risk of slowflation is more tangible than ever. Given such prospects we have identified three main concerns that have and will continue to affect investors over the coming months.

1. We see global inflation become more and more persistent as we go

The past decade was clearly marked by a trend of low global growth and deflationary forces. It is also these deflationary forces that drove most central banks’ very accommodative policies, to which we easily got accustomed to. Consequently, in the past decade (ending in 2020-2021), we had on the one hand fixed income markets continuing their bull trend, while on the other hand commodities and certain currency baskets for instance, performed poorly (in relative terms).

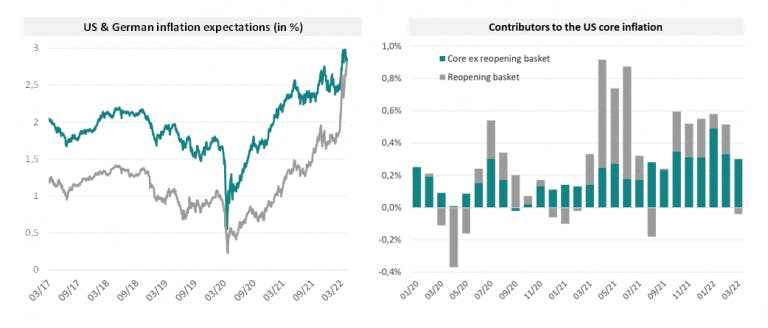

This global picture has dramatically changed as of late. What we have witnessed in recent months is that overall inflation has not only increased but also expanded (in terms of affected sectors). It is no longer confined to a few COVID-sensitive sectors but now includes areas and categories in which elevated rates of inflation tend to stick around for longer, hence become more persistent going forward.

On top of which, come cost pressures notably linked to commodity prices and supply chain disruptions resulting from the Russia-Ukraine crisis or the Chinese zero-Covid lockdown policies. These are undoubtfully adding more stress to this already volatile trend.

We now expect inflation to be past peak levels, therefore inflecting, but persistently above the 2% threshold throughout 2022 and into 2023.

-

Source: Carmignac, Bloomberg, April 2022

So, in a context of rising interest rates but persistently strong inflation, fixed income investors are left with little options in the short run that help to pass through the storm. Certainly, commodities or commodity linked assets (such as selected currency baskets) have so far proven successful.

Market implications: The main takeaway in the current context seems to be the unavoidable hawkishness of the Federal Reserve. In fact, the Fed wants to bring inflation down at any cost. It directly implies, lower growth, hence lower equities, and potentially further widening credit spreads. As a matter of fact, for now, central bankers seem to have made their choice between inflation and growth.

2. The “Commodity Super-Cycle” reflected in currency baskets

As mentioned above, commodities follow ‘super-cycle’ trends which tend to be ‘longer than’, and ‘less related to’ economic cycles. The last commodity super-cycle (2002 – 2008) for instance was mainly driven by demand (the latter fed itself by Chinese economic ‘super growth’ and that of Emerging Market countries more broadly of course).

We are now at the beginning of a new commodity upswing, driven by supply, which has started in our view in 2020 and will most likely drive the new macro-economic regime with notably: stronger inflation and more hawkish central banks (at least in the short run) etc.

And while, the recent geopolitical events have ‘tactically’ strengthened this bull commodity super-cycle, (gas and oil but also agriculture commodities’ prices are a good example, since cereals and fertilizers are among the most exposed to the Russian conflict in Ukraine) – On the longer run, commodities will also be supported by the green revolution. Having said that, currently we remain cautious with regards to the situation in China as the countries zero-covid policy could directly affect demand on commodities and hence prices.

Lastly, in our view, this commodity super-trend should continue put aside any short-term gas and oil price-fluctuations, Chinese slow-down related demand, or surprising developments of the geopolitical order.

Market implications: The Latin American countries for instance, have benefited from the rise of oil and gas but also from "soft commodities" prices (i.e. corn, wheat, soyabeans, etc.) following the disruptions of production in Ukraine, which was one of the largest producers of wheat and corn worldwide. Hence countries such as Brazil, Chili, Colombia, Uruguay, Mexico were positioned among the front-runners.

The first assets to have reacted are in fact currencies which are closely correlated to commodity cycles and highly liquid. Latin American currencies for instance have indeed outperformed other Emerging Markets regions, especially at the peak of the crises (but not limited to this period).

This upturn has profited to the performance of our Carmignac Global Bond fund and strategy thanks to our long positioning in FX strategies during Q1 2022 (whether it be our long positions on commodity related Latin American currencies or our long positioning on the Canadian dollar or our shorts on the Yuan and other related Asian currencies for instance). Note, that we decided to tactically take our profits on our main commodity-linked currencies positions.

3. Geographical dissonance and growth differential

The macro-economic horizon is not looking exactly similar for each of the main economic blocks and regions whether it be in terms of growth prospects, inflation forecasts or monetary policies.

And while the Q1-2022 is making bond market history with notably the largest quarterly increase for the US 2-year Treasury yields, most Emerging Market countries are on the other hand giving hints of an ending hiking cycle.

In that sense, central banks in Latin America for instance were the first ones to end monetary easing as soon as Q1 2021. This perspective on the current level of yields and the path for interest rates going forward is an additional support for local assets on the mid to long-term (the first one being in our view commodities).

Inflation is yet another example of continued desynchronization (but also closely linked to global growth and central banks policies). We notice that inflation in Asian countries for instance (or even in other regions of the world, such as Israel) remains relatively low. And while we still believe that global inflation will “pinch on” global growth prospects, it is also clear that the story varies somehow from country to country.

Finally, GDP numbers and forward-looking prints, also seem to contrast.

- On one hand, the United States and Canada are still posting decent growth figures (although on a slowing trend);

- Europe remains very fragile and ‘commodity-prices-dependent’ and therefore paying the highest toll in terms of consequences from the Russian invasion of Ukraine;

- Lastly, China is once again hit by a large scale close-down as Omicron infections skyrocket which would certainly impact its growth forecasts going forward with the very disappointing recent PMI figures published in China. It also raises some questions on up-coming “deja-vu” supply chain bottlenecks.

Positioning & Performance drivers

Where does it leave us in terms of positioning? Our current positioning is in line with the above identified trends.

Carmignac Portfolio Global Bond A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

CREDIT: Credit risk is the risk that the issuer may default.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Carmignac Portfolio Global Bond A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Global Bond A EUR Acc | +13.78 % | +3.33 % | +9.46 % | +0.10 % | -3.66 % | +8.36 % | +4.70 % | +0.12 % | -5.56 % | +3.02 % | -0.60 % |

| Reference Indicator | +14.63 % | +8.49 % | +4.60 % | -6.16 % | +4.35 % | +7.97 % | +0.62 % | +0.60 % | -11.79 % | +0.50 % | -1.64 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio Global Bond A EUR Acc | -0.73 % | +0.82 % | +2.46 % |

| Reference Indicator | -3.76 % | -2.06 % | +1.39 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 2,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,20% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 1,36% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |