Flash Note

When is the right time to invest?

- Published

-

Length

2 minute(s) read

It can be difficult to predict stock market price trends, even for the most knowledgeable of professionals, as the financial markets are influenced by many factors (geopolitics, economics, etc.). However, there are ways to invest with peace of mind.

Is there a right time to invest? How can you make sure you don’t pick the wrong time? These are some of the many questions you may have when investing your savings.

While no one is immune to events that could disrupt the financial markets, as was recently the case with the COVID-19 pandemic and the war in Ukraine, most people agree on one thing: it’s important to invest your savings gradually. This may take the form of regular investments or instalments, or scheduled payments that allow for automatic and periodic investment in one or more savings products.

Why should I invest regularly?

To limit risk, it is advisable to invest regularly without agonising over when is the ideal time to do so – that will only become clear with hindsight. This is a strategy for overcoming the uncertainties of the financial markets. Some months, investors will win, and other months not. But, by investing regularly, investors will be able to smooth out the performance of their investments.

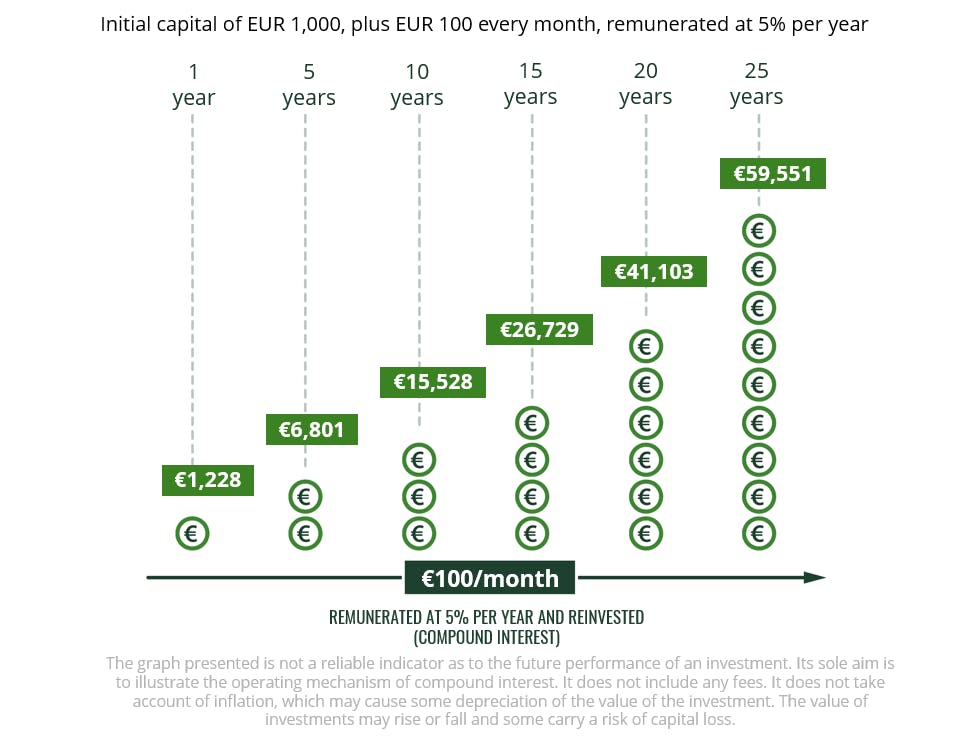

Regularity is also key because this strategy makes it easier to save by investing the same amount every month. For that, it is never too early to start. The earlier you save, the more your capital will be able to grow and,over time, interest will be added to your capital and this interest will, in turn, earn more interest. That’s the beauty of compound interest.

The beauty of compound returns:

Why is it important to invest over the long-term?

Statistically, investing over the long-term can be a winning strategy. In the United States, for example, the average annual return generated by the S&P 500 – the stock market index1 which includes the 500 largest US companies – amounts to 10.5% from 1965 to 2021 by reinvesting the dividends paid.

In addition, duration helps to smooth the volatility of the financial markets. Statistically, the longer the investment period, the less frequent the losses. Thus, according to a study by the Autorité des marchés financiers (AMF) conducted from 1950-2020, the expected average annual gain can reach 36% by holding French shares for three years, but with a potential loss of over 18%. Conversely, by holding these same shares for 20 years, the potential gain is 13.6% for a risk of loss reduced to 3%.

In addition, investing for the long-term has benefits across the economy, from financing infrastructure and innovative projects to developing startups. Added to this is a strong societal dimension since the time also allows companies to be supported in their efforts to improve governance, their carbon footprint and employee management.

Nevertheless, investment choices will be guided primarily by the investor’s own objectives. For example, to build a deposit to purchase their primary residence, investors will favour short or medium-term investments. On the other hand, financing retirement will be a long-term endeavour.

1 A stock market index groups together equities, making it possible to assess the performance of a market or sector. It is an essential instrument of asset management that is often used as a benchmark to measure portfolio managers’ performance.