Carmignac Sécurité: 35 years of regular returns and limited volatility

In 1989, Edouard Carmignac launched Carmignac Sécurité, a flexible,

non-benchmarked fixed income fund aiming to deliver consistent returns while maintaining a strong emphasis on downside risk management. 35 years later, Carmignac Sécurité remains loyal to its core philosophy which is as relevant today as it was in 1989.

Source: Carmignac, Morningstar, 28/03/2024.

Evolving to pursue the same mission since 1989

When Edouard Carmignac launched the Fund, his vision was to provide investors with a conservative solution able to deliver regular returns with limited volatility.

Over the past 35 years the Fund remained loyal to its core philosophy while demonstrating its ability to adapt to the ever-changing market environment by:

Broadening the investment universe

- Inclusion of bonds and other debt securities denominated in euros.

- Expanded allocation to high yield segment: 10% in private issuers and 10% in sovereigns.

Reinforcing risk management

- Active implementation of hedging strategies.

- Established minimum average rating for holdings in the Fund “investment grade”.

- Enlarged modified duration range from -3 to 4.

Strengthening expertise

- Reinforced credit expertise with a team dedicated to the asset class.

For 35 years, we have maintained our active and conviction-driven approach, while being able to adapt to different market configurations. This is what we want to continue offering to investors.

![[Management Team] [Author] Allier Marie Anne](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Allier-Marie-Anne.png?auto=format%2Ccompress&fit=fill&w=3840)

Marie-Anne Allier

A philosophy which proved its relevance over the years

Carmignac Sécurité’s flexible investment style allowed the Fund to withstand the various major crises of the past decades:

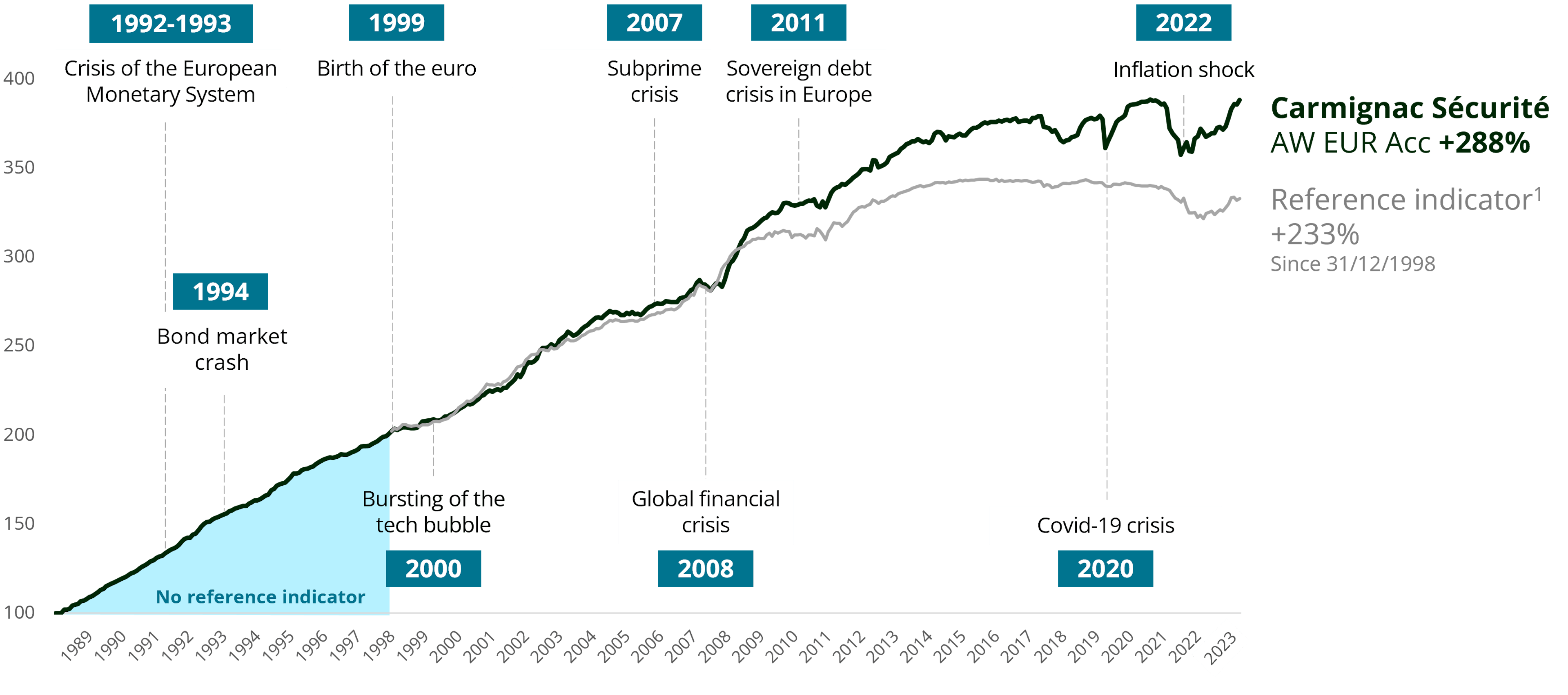

Cumulative Performance of Carmignac Sécurité since inception to 28/03/2024

Source: Carmignac. Cumulative performance from the Fund’s launch on 26/01/1989 to 28/03/2024 and for the reference indicator from 31/12/1998 to 28/03/2024. (1) Reference indicator: ICE BofA ML 1-3 Year All Euro Government Index (Coupons reinvested). Until 31 December 2020, the reference indicator was the Euro MTS 1-3 years (since 31/12/1998 – date of creation of the Euro and the Euro MTS 1-3 years index). Performances are presented using the chaining method. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor), where applicable. The return may increase or decrease resulting from currency fluctuations, for the shares which are not currency-hedged.

A positive outlook for Carmignac Sécurité

The new interest rate environment has created opportunities. With yield to maturity of 4.7%3 as at 28/03/2024, a level rarely seen since the great financial crisis of 2008, we believe Carmignac Sécurité offers attractive performance potential over the next 12 months and therefore an attractive entry point.

While carry will be one of the main sources of performance over the coming months, Carmignac Sécurité also has a wide range of tools at its disposal to boost performance and benefit from the expected interest rate cuts by central banks from June 2024 onwards, and - managing the risks - in line with our convictions:

- Active duration management to navigate a rate environment that is likely to remain volatile, while positioning the portfolio for a cutting rate cycle.

- Credit assets offering an attractive source of carry which currently represents two thirds of the portfolio, with a focus on defensive segments (mainly highly rated short-dated bonds where we favour energy, financials, and CLOs).

- Money market instruments which provide an attractive source of carry with limited risk and enable the fund to seize opportunities.

Want to know more about Carmignac Sécurité?

Visit the Fund pageCarmignac Sécurité AW EUR Acc

- Recommended minimum investment horizon

- 2 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 1,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,11% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- There is no performance fee for this product.

- Transaction Cost

- 0,24% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Annualised Performance

| Carmignac Sécurité | 1.7 | 1.1 | 2.1 | 0.0 | -3.0 | 3.6 | 2.0 | 0.2 | -4.8 | 4.1 |

| Reference Indicator | 1.8 | 0.7 | 0.3 | -0.4 | -0.3 | 0.1 | -0.2 | -0.7 | -4.8 | 3.4 |

| Carmignac Sécurité | + 0.1 % | + 1.1 % | + 0.7 % |

| Reference Indicator | - 0.7 % | - 0.5 % | - 0.1 % |

Source: Carmignac at 28 Mar 2024.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Related articles

How do Chinese companies succeed internationally

Carmignac Portfolio Grandchildren awarded for its sustainable approach

MARKETING COMMUNICATION. Please refer to the KID/prospectus of the Fund before making any final investment decisions. This document is intended for professional clients. This document may not be reproduced, in whole or in part, without prior authorisation from the management company. It does not constitute a subscription offer, nor does it constitute investment advice. The information contained in this document may be partial information and may be modified without prior notice. The decision to invest in the promoted fund should consider all its characteristics or objectives as described in its prospectus. The reference to a ranking or prize, is no guarantee of the future results of the UCITS or the manager. Carmignac Sécurité is a common fund in contractual form (FCP) conforming to the UCITS Directive under French law. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease because of currency fluctuations. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. Access to the Fund may be subject to restrictions regarding certain persons or countries. The Fund is not registered in North America, South America, Asia, or Japan. The Funds are registered in Singapore as a restricted foreign scheme (for professional clients only). The Fund has not been registered under the US Securities Act of 1933. The Fund may not be offered or sold, directly or indirectly, for the benefit or on behalf of a “U.S. person”, according to the definition of the US Regulation S and/or FATCA. The Fund presents a risk of loss of capital. The risks and fees are described in the KID (Key Information Document). The Fund’s prospectus, KID and annual reports are available at www.carmignac.com, or upon request to the Management Company. The KID must be made available to the subscriber prior to subscription.

• In Switzerland, the Fund’s prospectus, KID, and annual reports are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon. The KID must be made available to the subscriber prior to subscription. The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in French, English, German, Dutch, Spanish, Italian at the following link “Summary of investor rights”): https://www.carmignac.com/en_US/article-page/regulatory-information-1788.